It’s that time of year again when we reflect on what transpired over the current calendar year and look forward to what may come in the next. There will be plenty of reviews published by credible investment houses, so we will keep ours brief, and concentrate more on what we think the probabilities for the future are.

As we entered 2023, we (along with many others) were worried about a slowdown or possible recession in the US. In March when Signature Bank and SVB collapsed overnight, there were strong suggestions this was the start of something much bigger at hand. At the time we didn’t think it suggested an impending banking crisis (as we stated in our communications), but the resilience of the US consumer did surprise us in the face of an extremely fast rate hiking cycle.

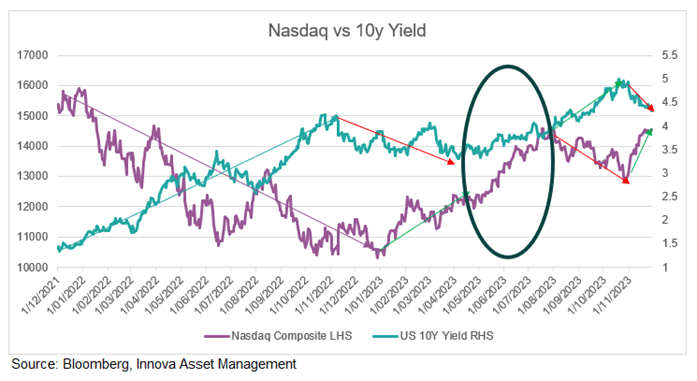

However, something strange happened around the middle of 2023. As yields were going up (and therefore the cost of capital and discount rate[1]), we saw the AI fuelled rally which dominated headlines in 2023 continue. To us, this didn’t make sense – we used the analogy of the 4 legs of a chair. These equities were rising based on 4 things: 1. Robust US GDP growth, 2. Falling inflation, 3. High employment, and 4. An assumption of significant rate cuts from the Fed. To us (and our modelling forecasts), these 4 shouldn’t hold at the same time. Our models suggest that the GDP readings aren’t as robust as the headlines would make them look, so if rate cuts were to occur it would be because either the equity market broke (for a litany of reasons[2]) or the economy broke i.e. went into recession. If on the other hand we were wrong about the fragility of US GDP, and inflation continued to fall, what impetus would there be for the Fed to cut rates? This was playing out from about April/May right up until August:

Then in August, tough talk from the Fed caused the market to catch on to the same thing, and we saw a 10% fall in the tech-heavy Nasdaq. It wasn’t until November, when Jerome Powell came out saying the bond market was doing the heavy lifting for them that the market violently started pricing rate cuts in again, and we saw a very strong rebound and equities went up as yields fell once again.

Outlook

So, what do the events of 2023 help inform us of what is likely to ensue in 2024 and beyond. In short, probably not as much as we think. Some common behavioural biases amongst investors include the tendency to anchor to arbitrary events (the ‘anchoring’ bias), as well as assume what happened recently will continue into the future (the ‘recency bias’). What will happen going forward will be a function of the environment at the time. The future is always uncertain, so Innova try to gauge probabilities and build resilience into our portfolios so they should perform well in most scenarios. This means we don’t take big one-way bets on events, and so don’t have giant wins or losses in our portfolios that drive the results.

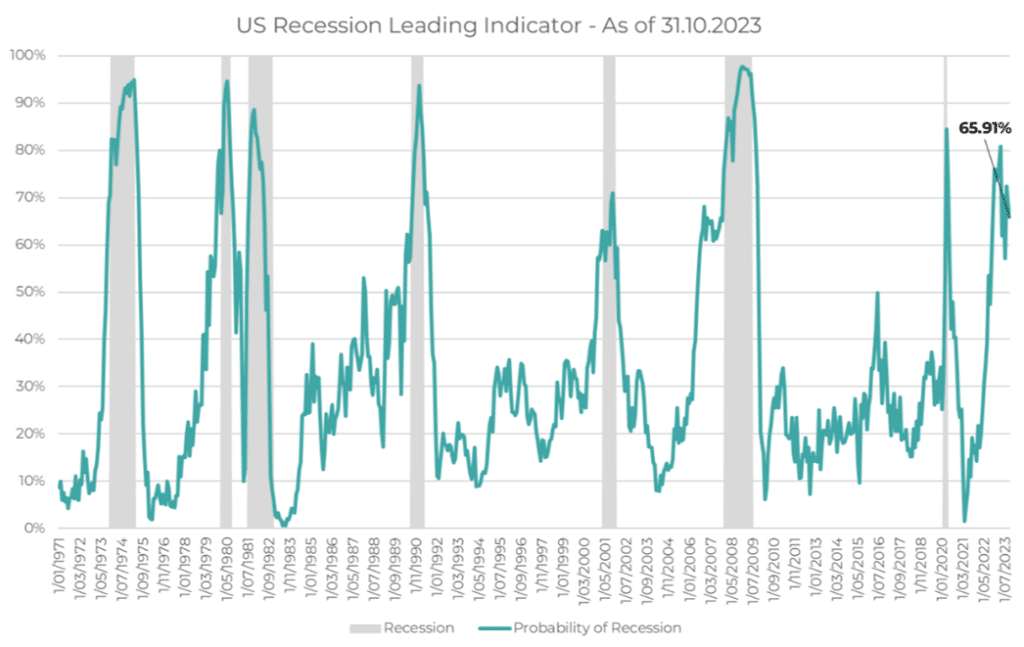

We still believe that the US economy is not as stable as the headline numbers and backwards-looking data suggest, but the probability of recession has fallen somewhat:

However, as we highlighted in this article published in September, the market is providing many opportunities to buy assets that could offer some protection if markets fall, but should also offer greater upside if equities (or Bonds) continue to rally. If we are completely wrong that the 4 legs of that chair can’t hold at the same time, then the logical place to invest is in those areas that haven’t benefitted from the recent rhetoric – and those happen to be the same places that should offer some downside protection if one of those chair legs disappears and equity markets fall. In short, we think the mega cap growth stocks in the US are priced to future perfection, so are unlikely to live up to the price paid for them and we don’t think they’ll be the leaders if this becomes a persistent rally and new equity bull market.

A more likely scenario is that broader cyclical areas, including consumer discretionary, materials, regions such as emerging markets and the UK, as well as Australia (where we recently increased our allocation, after divesting in December 2022) would be more likely to benefit from further upside. In addition, fixed-rate Government bonds are offering reasonably high nominal yields, which will become more attractive if inflation continues to recede. They should also be a valuable source of diversification if economies globally start to crack under the weight of higher borrowing costs and we see this translate through to company earnings and their stock prices. So, we have:

- Maintained our defensive positioning. Underlying fundamentals have improved somewhat over the course of the year, but not enough to warrant a big allocation to riskier market segments.

- We increased, and are considering increasing further, our allocation to fixed-rate Government bonds.

- Sectors and styles that are priced reasonably attractively make up the bulk of our equities allocation (Value-style equities, regions like Australia, the UK and emerging markets)

- We’re looking at investments that have done particularly poorly that might provide additional upside potential without adding additional downside risk. The best hunting ground we have found to research in this area is amongst global small caps.

- We are also considering reducing some of our less interest-rate insensitive assets, and allocating more to those areas that have been either beaten up or didn’t participate in the 2023 rally.

Whilst we can’t predict what will happen in the future, we can try and stack the odds of success in our favour. That is how we have positioned our clients’ portfolios, and we are unlikely to change this unless the facts change. However, one thing that we do know will definitely happen in 2024 and beyond – prices will change. As things get either more or less attractive, we’ll allocate more to those areas that look attractive to us, and divest from those that don’t have as rosy an outlook because that is now reflected in

[1] Discount rate refers to the rate future cash flows of a business are discounted at in the future, to value them in the present. Basically, as these go up, the value of future cash flows down

[2] Usually when markets fall, it is only with hindsight one can point to the cause. But there were and still are plenty of things that could cause it to fall: unexpected rate hikes, reduced consumer demand, falling profitability, a geo-political event etc.