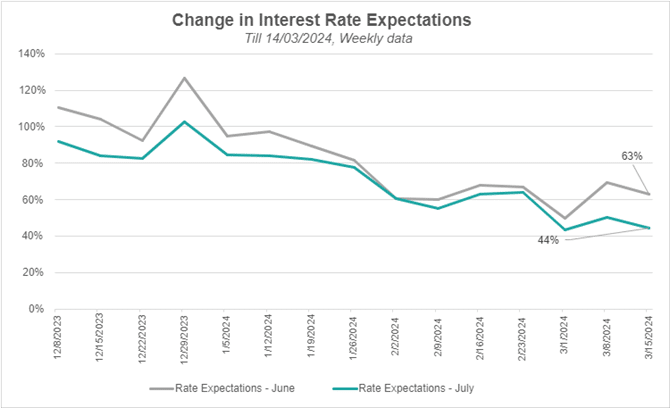

Up until last night, the US equity market has been on a steady upward trajectory since October 27 last year. What spurred this rally initially were perceived ‘dovish’[1] comments from the Federal Reserve, interpreted by the market to mean that the Fed, and de-facto other Central Banks, could start cutting interest rates soon, and the magnitude of those cuts was quite elevated. As early as January, the market was pricing in a high probability that the first rate cut from the Fed could be as early as Q1 of this calendar year, and 6 cuts of 0.25% (so 1.5% in total) throughout 2024. We maintained the stance that we thought this was far too optimistic, as inflation hadn’t yet fallen to the US’s 2% target and economic growth, as well as employment looked far more robust – so why would they cut rates and potentially re-stoke inflation pressure?

Source: Bloomberg

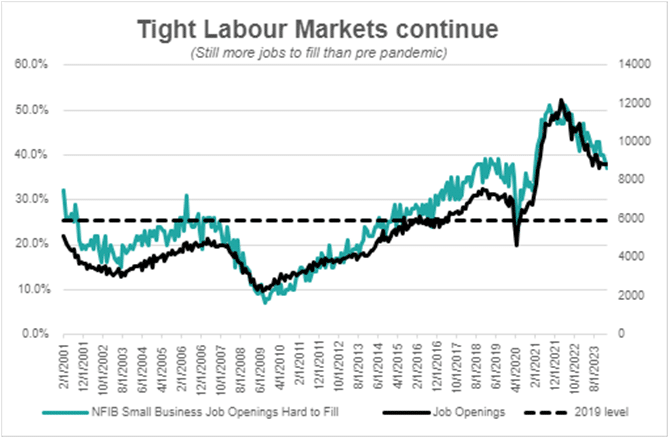

We can see from the above two charts that rate cut expectations have been pushed out to later in the year, and that the labour market in the US remains strong and tight.

However, even though expectations of rate cuts fuelled the rally early on, as rate cut expectations have been pushed out and the magnitude of cuts being reduced, the equity market continued it’s march north. Further, we saw a broadening in the rally, whereby it was initially being driven almost solely by the ‘Magnificent 7’ (the 7 largest companies listed on the S&P500), to a broader based rally as other segments of the market started to play catch up. In fact, the Magnificent 7 rhetoric was being changed to the Fantastic 4 as stocks such as Apple and Tesla began to disappoint markets, and companies such as Nvidia, Meta (the head company of Facebook) and Microsoft started carrying the load of the mega-caps. Whilst this was occurring and the concentration in the largest part of the market was shrinking, more broad-based equity markets started to rally (such as the US Equal Weight index and S&P midcap 400 index).

So, this move overnight leaves us with a bit of a paradox – to date, rate cut expectations have been shrugged off even though they were the initial spark that started this bull run, yet overnight they caused a large one-off fall in equities and bonds. Logically, higher rates for longer should represent a higher cost of capital for businesses, higher discount rate which lower future cash flows calculations and furthermore the sectors that are highly interest-rate sensitive should face further pressure. However, the areas that are more cyclical and economically linked, which didn’t fully participate in the rally, should continue to outperform. This has not yet happened, but we are starting to see early signs of this (which we’ll cover below).

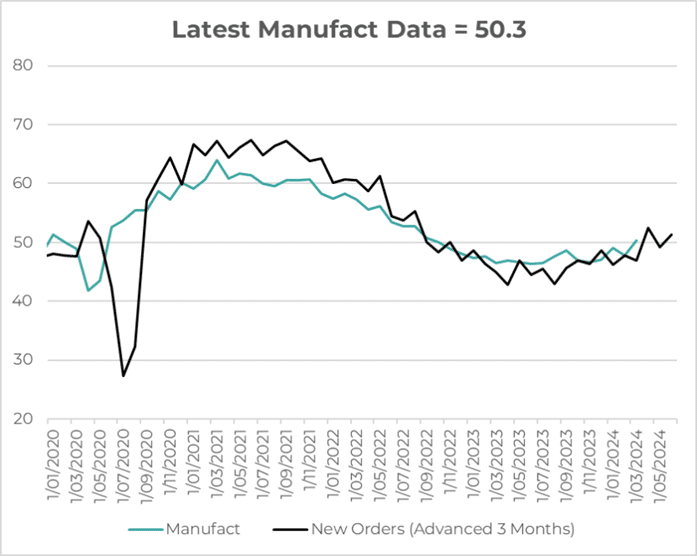

Our view is that the US economy is showing signs of resilience, and the likelihood of recession has meaningfully fallen as inflation has come down. The manufacturing sector, which had been in contraction for 16 months, has turned around and is back in expansionary territory. Whilst it is still early days with the data, and this might be a short-term blip before it turns back to contraction, the trajectory and trend of the manufacturing data is turning more positive:

Source: Bloomberg, ISM

We have been quite vocal that we thought the larger end of the US market which had priced in essentially a goldilocks scenario of falling rates, falling inflation and positive GDP growth should come under pressure as those rate cut and inflation expectations start to become more realistic. We’ve advocated allocating to styles, factors and sectors that hadn’t priced in this goldilocks scenario – this includes styles such as ‘Value’ investing, which by their nature are far less interest rate sensitive but much more economically sensitive. Also, areas such as smaller companies, sectors such as mining, consumer discretionary and utilities, as well as regions like South Korea and the UK presented better pricing, were more economically linked and had less optimistic forecasts of future growth potential. Whilst these areas have lagged the broader momentum trade in US mega caps and the Japanese stock market, they present what we believe to have an asymmetric payoff profile – if there were to be a stock market correction, their lower price should offer a downside buffer against the nastiest of falls. On the flip side however, if the economy (both in the US and globally) presented stronger data (which it has been), and better future prospects for growth, they should be greater beneficiaries of this growth. Overnight we saw these areas much less susceptible to the downward fall, and over the last week and month have provided outperformance against the MSCI ACWI and S&P500.

To us this makes sense. Economic conditions continue to surprise to the upside in the US, and those areas that could be labelled as ‘growth’ have greater interest rate sensitivity because more of their future cash flows are being priced into today’s pricing. So logically, higher interest rates should hurt these ‘growth’ segments but benefit those that are economically linked however not priced to perfection. Further, the US economy should be more resilient to higher interest rates due to the concentration of mortgages being fixed rate, as opposed to economies such as Australia or Canada with greater floating rate mortgage usage.

However, a global economic rebound is certainly not assured, and we have had previous events where a fall in the share market has driven a subsequent recession – the two most obvious examples being the GFC and Tech-Wreck of 2000. To us there are 3 major risks to be aware of and have hedges in place for: 1. A market driven fall in equity prices because prices just got too high. 2. A growth shock where growth begins to disappoint, and the recent positive trend reverses itself; and 3. An inflation shock where inflation remains persistently high or potentially increases again and this has not been factored into markets. To balance out these three risks we have taken specific measures to have some hedges in place in case one of them occurs.

In the first scenario, having more defensive assets in your portfolio such as high investment grade bonds, Government bonds and less richly priced equities should offer some protection. Under the second scenario, Government bonds that are now yielding 4%+ should offer protection against a growth shock as this feeds into equity market pricing. For the third scenario, an allocation to floating rate bonds instead of all fixed rate bonds should offer some protection against rising inflation driving up interest rates again. In addition, certain alternative strategies can offer a good inflation hedge, one of those is potentially commodities (which we have seen rally strongly over the last 6 months) though they are hard to invest in directly. We have used Trend Following historically, and are looking to deploy an allocation to a diversified strategy that has inflation protection mechanisms built into it’s construction and performed very well in 2022.

However, we think those 3 risk scenarios are currently a low-probability of occurring, so our main theme is to invest in fairly priced assets, with a slight underweight to equities as the largest equity market in the world, the US, at a broad index level is looking quite expensive. History has shown us it can get much more expensive from here, however a sustained bull market (lasting 5 years +) has never begun from these sorts of valuations. So instead, allocate to areas that have not priced in perfection, should offer some downside protection if one of these risks comes to fruition, but importantly should offer greater upside if economic conditions continue to improve. Whilst this stance hasn’t benefitted the portfolios for the large part of this year, the logic and evidence behind it remains sound. What we don’t want to do is start chasing returns, only to find the market wake up one day and realise it’s too far over its ski’s and needs to price correct to bring it back into line with reality.

[1] ‘Dovish’ commentary means that the Fed sounds more likely to cut rates. ‘Hawkish’ commentary means it’s more likely to maintain current interest rates or have a hiking bias.

Quarterly market update | Q2 2025