For those who have been market participants for the past 15 years, it may have taken some time to adjust to how market reacts to common macroeconomic data prints nowadays.

Of course, investors grapple with unique challenges in the world today. Therefore, it’s important that we consider how the dynamics of pricing have also changed…

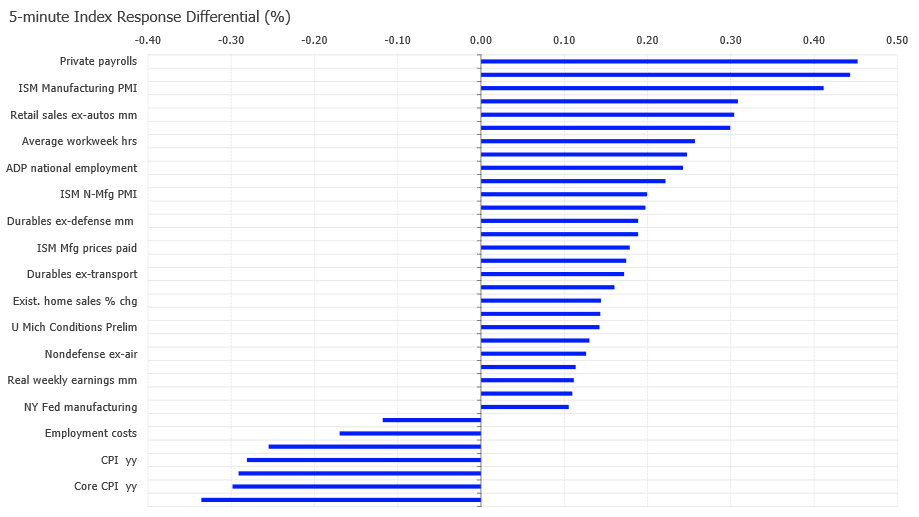

For some time now, participants view the softening of growth, manufacturing activities, retails sales and labour data as positive—rather than intuitively negative, as was the case a decade ago.

The primary reasons for this as we know, but are not limited to, are:

- Expected inflation,

- Inflation volatility

However, first and foremost is the response from the US Federal Reserve and other central banks. Attuned to the cues from central banks, investors find themselves navigating a landscape where the celebration of economic prosperity is tempered by the fear of policy tightening.

Positive economic indicators that traditionally drive market optimism can paradoxically lead to heightened volatility—as investors brace for the potential impact of tighter monetary conditions.

Below we can see a study from 2009-2022 for the S&P 500’s price reaction to economic data surprises, where usually data such as PMI, retail sales and payrolls surprising on the upside (good news) actually translates to good news for stock prices under a “QE” mindset.

Source: London Stock Exchange Group

There seems to be an inbuilt conditioning for investors to speculate on the timing of rate cuts immediately, having grown accustomed to a liquidity-filled, low inflation world, where central banks swoop in to save the day with easier financial conditions.

Whilst it’s true that governments and central banks’ tolerance for stimulus and liquidity injections has lowered— i.e., it requires a less severe event for them to immediately support a particular sector in a dire credit or financial stress scenario—there seems to be complacency in the way markets are reacting to economic prints. Just in the recent October CPI print, we saw a very slight surprise to the downside by 0.1%. Slower than expected inflation caused absolute euphoria in risk assets, with a ~2% rise in S&P 500 and 20bps rally in 10Y Yields.

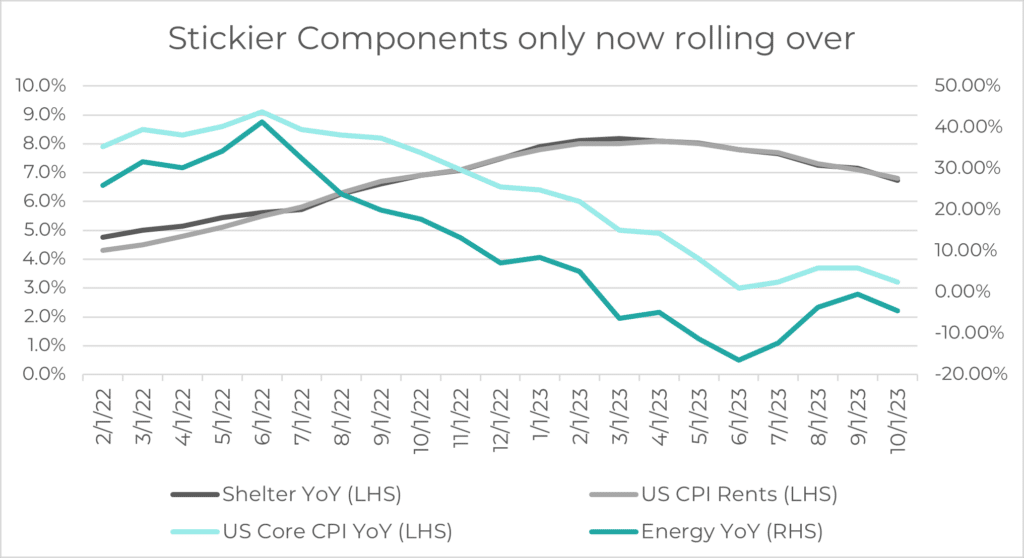

Although economic prints are influenced by various factors, a closer look at the details of the October CPI print reveal that much of the slowdown is attributable to a more cyclical component—energy, which had stabilised during the month.

While it is evident that inflation is moderating, there remains uncertainty about whether we will stabilize around the 2% target.

Being cyclical in nature, inflation could bottom at higher lows than observed before the COVID-19 pandemic, which is concerning for risk-assets, yet markets continue to react and price in a return to a “norm” that may not align with the evolving economic landscape.

Source: Innova Asset Management, Bloomberg

Power to the People!

Investors ultimately fear a recession via the overtightening of financial conditions.

This fear is rational since an economic downturn would lead to material impacts on living standards and consumption behaviour, even though recessions are very natural and a productive part of the business cycle.

Given the Fed’s dual mandate objectives of low unemployment and stable inflation, it makes sense to address two commonly asked questions from our investors that could be relevant for your portfolio:

- What are the key developments in employment and inflation?

- Should the effects of tighter financial conditions warrant concern?

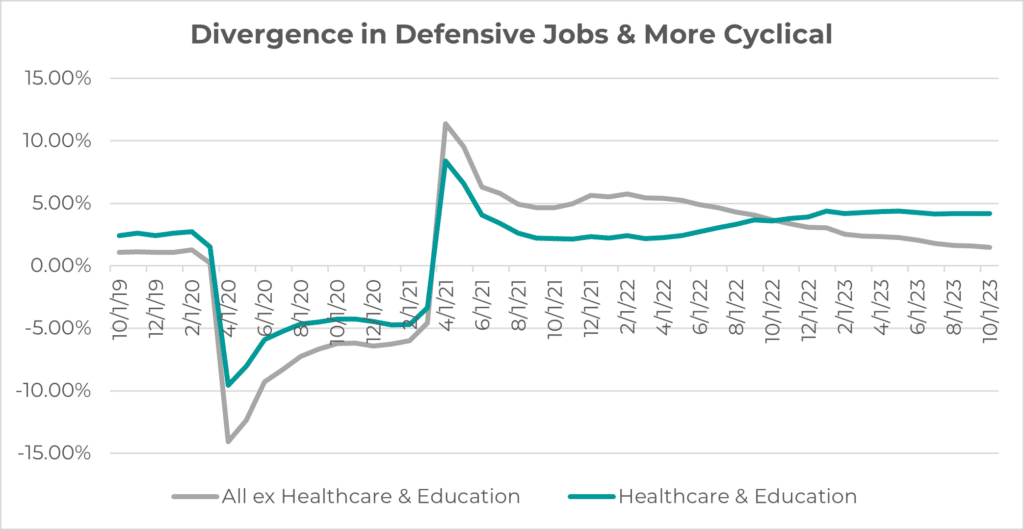

The repercussions on the labour market often exhibit a substantial lag following periods of interest rate hikes. However, potential issues and vulnerabilities can be discerned through more proactive leading indicators.

The impact of elevated borrowing costs on businesses appears to unfold gradually, delaying significant workforce reductions.

This delay is especially pronounced when transitioning from a period of tight labour market conditions, where employers strive to retain their skilled workforce, ultimately contributing to wage growth in 2022. The COVID stimulus not only provided companies with access to financing at remarkably low 0-2% interest rates but also prompted a frenzied hiring spree.

Nevertheless, signs of deceleration are evident, particularly in more non-essential and cyclical sectors which bear the brunt of this slowdown.

Source: Innova Asset Management, Bloomberg

Source: Innova Asset Management, Bloomberg

Companies recognise the value of skilled workers, especially in a tight labour market.

In a post-pandemic environment, businesses are hesitant to part with quality talent. Employees seem to hold more power amid the current trends of deglobalisation and onshoring, especially since the halt in post-pandemic immigration.

The number of strikes in developed markets has also increased. United Auto Workers is a recent case that had a material impact on nonfarm payrolls and symbolic of the bargaining power gained by employees.

Are we witnessing new labour market dynamics taking shape?

Current State

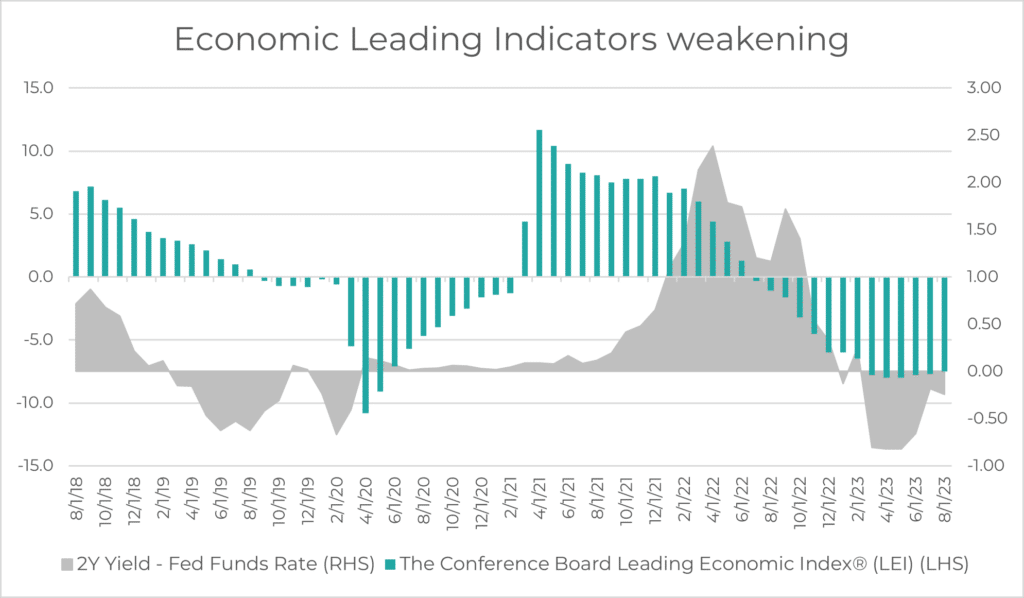

Softening data has come about after a whopping 4.9% Q3 GDP print:

- Consumer sentiment is showing signs of weakness.

- Vacancy rates and unaffordable housing are on the rise.

- Non-defensive labour market data is indicating a decline in strength.

- Manufacturing and industrial production data are experiencing a slowdown (though had a slight uptick).

Source: Innova Asset Management, Bloomberg

While consumer resilience in 2023 is a welcome surprise, the impact of stimulus measures introduced during COVID is gradually waning, potentially nudging individuals back into the workforce.

Anticipating a deceleration in growth and decrease in wage pressures as the labour market becomes more crowded, uncertainties linger about the inflation outlook.

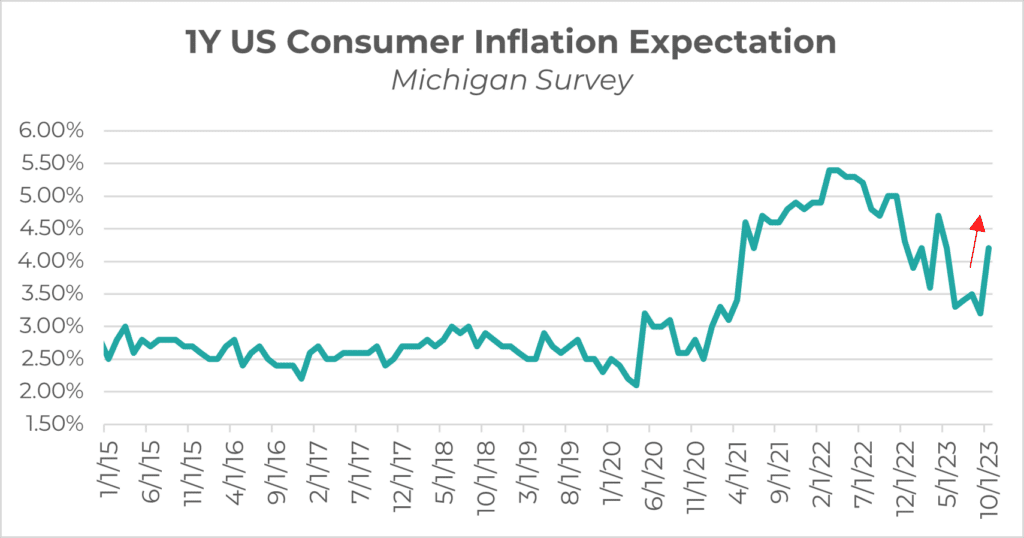

Strong consumer performance in 2023 may flow into further inflation volatility concerns for 2024, with recent US consumer inflation expectations up to 4.2%:

Source: Innova Asset Management, FRED

Typical cycles start out with “Good news is good news”, before moving to “Good news is Bad news”. This is where we find ourselves now.

Bad news is viewed is bad news again later in the cycle. In this final stage, we typically see:

- Cracks appear in coincident indicators such as inflation, unemployment, initial jobless claims

- A potential risk-asset capitulation

We have not yet reached the final stage. While the rule is not infallible, it is worth noting as we prepare to take on exciting possibilities and challenges that await us in the new year ahead.

Quarterly market update | Q2 2025