Analysis: Younger Australians in default MySuper funds missing out on returns

More than 5.2 million young Australians are missing out on higher super returns by leaving their retirement savings in default MySuper accounts, according to an analysis of APRA data by Innova Asset Management[1].

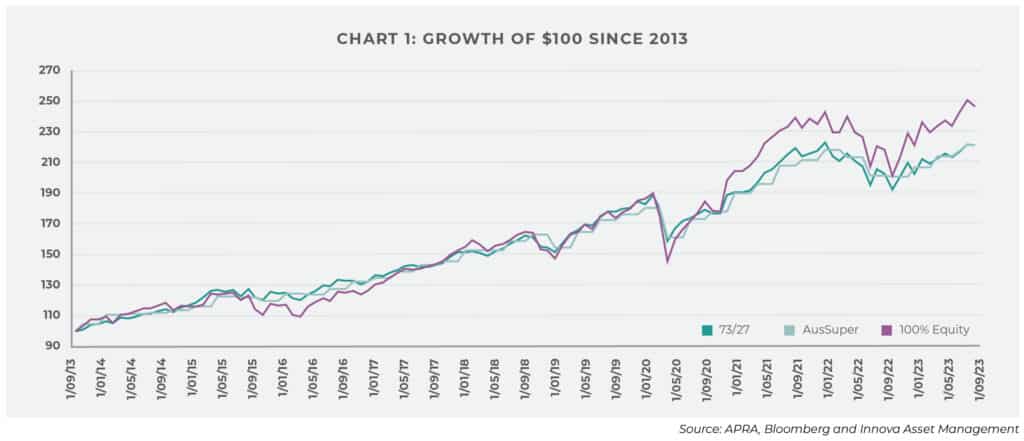

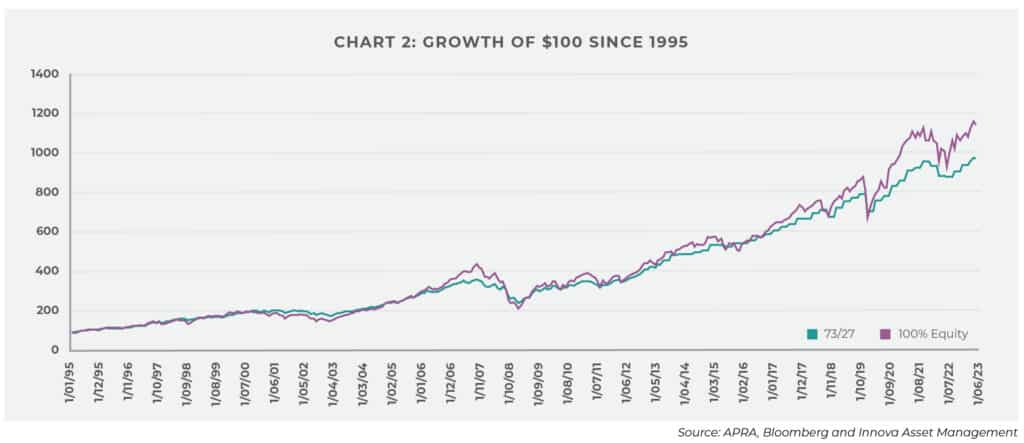

An all equities portfolio[2] outperformed the typical MySuper ‘balanced’ fund by 13.6 per cent over the decade ended September 1, 2023, and by 16.8 per cent over the multi-decade period from January 1, 1995, to September 30, 2023.[3]

The problem is growing and suggests there is a great opportunity for financial advisers to expand into a younger client base.

More than 10 million MySuper accounts are now held by Australians under the age of 40, according to APRA data, meaning they face 25-45 year investment time frames before their super becomes accessible.

While it’s generally assumed that younger investors have relatively low levels of super, the APRA data shows a rising number are accumulating significant retirement savings at an earlier age.

Almost a quarter-of-a-million Australians (233,000) aged 30-34 hold between $100,000 and $499,999 in their MySuper accounts. Meanwhile, more than half a million (597,000) Australians aged 35-39 also have the same amount in MySuper[4].

While an all equities portfolio posted significantly more volatility (and periods of underperformance) over the period compared to MySuper, this tends to wash out over long investment time horizons, as shown in the graphs below.

The first chart maps the live data and development of a proxy MySuper offering (the 73/27 portfolio). It shows three investment options: AustralianSuper’s MySuper, a a 100 per cent equities portfolio (outlined in footnote 2), and a proxy portfolio designed by Innova to mimic the risk and return of the MySuper offering. The issue with this timeframe is that it’s too short – without a longer time horizon, which includes big market events like the GFC and tech-wreck, not much can be concluded.

To remedy this, we developed a MySuper proxy (labelled 73/27), which almost precisely tracks the typical MySuper offering in terms of risk and return. We can now use it to test longer time horizons in chart 2, where we ran the 73/27 portfolio from 1995 up until the MySuper data was available. This represented how MySuper would have performed since 1995. From 2013 onwards, we used actual MySuper data.

Younger investors: more assets, better financial advice needed

There are currently around 61 MySuper products, which were initially launched in 2013 as a low-cost, simple product suitable for the majority of investors.[5]

While a small number of MySuper products are lifecycle funds, which raise younger investors’ exposure to growth assets and lower it as they approach retirement, most have a static 70:30 growth-defensive portfolio.

MySuper products were designed to cater for a largely disengaged customer base given super’s distant financial payoff. Those least likely to be engaged – and so invest in default MySuper products – are the young, people with lower education, and those on lower incomes, according to the Productivity Commission.[6]

However, the APRA data shows there are a rising number of young people with significant retirement assets, suggesting they are likely to be well educated and on high incomes. Yet they remain invested in lower-returning MySuper products.

It is another window into the ongoing issue of financial advice accessibility. It also represents an opportunity for advisers, who are increasingly offering scaled financial advice.

A recent CFS survey showed that more than half (53%) of Australians under 40 were open to professional financial advice, but more than one-third (35%) believed they couldn’t afford it.

Some super funds are beginning to offer free automated advice that tackles super-specific areas such as appropriate investment (and insurance) options. However advisers are also beginning to offer one-off advice that caters to younger investors such as appropriate investment options, super contribution levels versus home ownership, and cashflow management.

Will equities still outperform in future for younger investors?

Younger investors are facing a more uncertain financial future than previous generations. A combination of legislative failures combined with years of ultra-low interest rates have made housing largely unaffordable.

Unfortunately housing forms a key component of a comfortable retirement alongside private savings (such as super) and the government’s Age Pension.

Housing provides safety and certainty, while most homeowners can still access the Age Pension because the value of their home isn’t means tested. By way of contrast, about one-quarter of retirees who rent privately are in financial stress given rental assistance is relatively low, according to the government’s Retirement Income Review.[7]

Younger investors will need to generate more wealth through other means, such as super, to compensate. While younger investors have the benefit of longer working lives and a rising superannuation guarantee, they will also need stronger long-term returns.

Are higher growth investment options such as equities the answer to generating the wealth they need?

While equity investment options have outperformed the median MySuper product (and its forerunner, the balanced fund), MySuper funds have still performed competitively. Past performance is also no indication of long-term future performance, particularly now that the market environment has radically changed.

Interest rates were cut in the wake of the 2008 Global Financial Crisis and again after the 2020 pandemic to historic lows, propelling equity markets to record highs. Interest rates have now risen, and may rise further, presenting a new headwind to prospective returns. The return on traditionally defensive assets such as sovereign bonds are offering better return potential now due to higher interest rates.

Equities should still outperform MySuper funds over multi-decade time horizons, although younger investors may also need to explore further ways to boost super performance while appropriately managing risk.

A simple reason for this is that by not being able to access the housing market, they can’t take advantage of what the previous generation was able to take advantage of – leverage. Even though interest rates were at eye-watering levels in the early eighties and nineties, houses only cost roughly 2-3 times one’s annual salary. That number is now more like 6-9 times, making it unaffordable. But it wasn’t house price appreciation that really generated the wealth, it was the ability to leverage up their housing deposit 400 per cent that generated the vast majority of the returns, so new, and well thought through strategies will be needed.

[1] There are 5,229,000 MySuper accounts held by investors up to 29 years of age. Quarterly Superannuation Industry publication | APRA. (2023, December 04). Tables 7 and 8. Retrieved from https://www.apra.gov.au/quarterly-superannuation-industry-publication. The APRA data refers to the number of MySuper accounts. While legislation has largely eliminated many duplicate accounts, in reality, a small number will still be held by some investors in these age brackets.

[2] 50% S&P/ASX200, 50% MSCI ACWI unhedged

[3] Details of the calculations here… Analysis is of a 73/27 hypothetical portfolio and of Australian Super’s actual quarterly data – the returns are about the same. Australian Super’s performance was above the median super fund performance where available.

[4]Quarterly Superannuation Industry publication | APRA. (2023, December 04). Tables 7 and 8. Retrieved from https://www.apra.gov.au/quarterly-superannuation-industry-publication. The APRA data refers to the number of MySuper accounts. While legislation has largely eliminated many duplicate accounts, in reality, a small number will still be held by some investors in these age brackets.

[5] Some of these funds are restricted to certain types of employees. YourSuper-Comparison-Tool. (2023, December 04). Retrieved from https://www.ato.gov.au/single-page-applications/yoursuper-comparison-tool

[6] Commission, C. (2019, January 10). Inquiry report – Superannuation: Assessing Efficiency and Competitiveness. Retrieved from https://www.pc.gov.au/inquiries/completed/superannuation/assessment/report

[7] Retirement Income Review – Final Report | Treasury.gov.au. (2023, November 14). Retrieved from https://treasury.gov.au/publication/p2020-100554

Quarterly market update | Q2 2025