Markets may be offering a way to have your cake and eat it too, so let’s take a look.

We have not shied away from calling the US ‘Magnificent 7’ rally into question, however we have also suggested other areas that might be more attractive to allocate your capital. In fact, it may be that markets are offering an opportunity to maximise returns if we are indeed on the cusp of a continued rally in equity markets and a rebounding global economy – and will likely offer protection even if there’s a downturn on the horizon. Whilst it may be impossible to have a long-only portfolio that will perform well in all prospective market conditions, the reality is that markets exist along a spectrum of probabilities and potential outcomes – and when you can find opportunities that can benefit from multiple scenarios, especially the highest probability ones, it pays to try and stack the odds in your favour and take advantage of them.

So, let’s think in terms of a bullish scenario (which is obviously not our base case, but that doesn’t really matter, as you’ll see). Let’s imagine that the US economy continues with robust economic growth numbers, this drives the global economic slump (looking at the EU and China) back into rebound territory, yet inflation retreats back to Central Bank targets AND they ease interest rates due to this[1]. In that scenario, the future performance of the 7 largest companies in the US seems to already be in the price:

Source: Bloomberg, Innova Asset Management. ‘Magnificent 7 Equal Weight’ is an equally weighted portfolio of the ‘Magnificent 7’ or ‘mag 7’: Apple, Microsoft, Alphabet (Google), Amazon, NVIDIA, Tesla and Meta (Facebook). S&P 493 is the remaining 493 stocks in the S&P500 index. All charts indexed to 10,000 starting values.

This is a very commonly produced chart, and often used to signal impending future market problems due to the concentration in the rally. But let’s assume we and others are wrong – the concentration of the rally is irrelevant. Instead, do we think that a market that is already pricing an unlikely (but not impossible) ‘threading of the needle’ by the Federal Reserve to balance positive economic growth and employment with a reduction in inflation (and reduced interest rates), is likely to continue to lead the rally? In such a scenario, wouldn’t areas that haven’t benefitted from what appears to be a structural A.I. driven boom, be the likely beneficiaries? It would seem logical. History suggests that this is usually the case, with styles such as ‘Value’ and overall cyclically exposed assets, typically doing better in recovering markets. In fact, our own internal study of corporate earnings and profit margins showed that from market troughs, the sectors that offered the strongest earnings growth and operating margins on average and across multiple regions were Energy, Real Estate, Consumer Discretionary, Financials and Healthcare – though Healthcare is clearly not considered a ‘cyclical’ sector or one that typically makes up a large allocation in ‘Value’ equity portfolios – however it has lagged meaningfully this year along with the more cyclical sectors[2].

The same can also be said of countries that are more heavily exposed to cyclical sectors, or display greater cyclicality – this includes regions we have mentioned previously: the FSTE100 in the UK’s is one example, with its largest sector exposures being energy (13.09%), Healthcare (12.79%) and Banking (10.32%). Areas such as South Korea (another favourite of ours) is a very cyclical region, as is Asia and Emerging markets in general – and they are priced at a meaningful discount to the US equity market.

However, as we have emphasised is one of our core investment principals, it is price that drives long-term returns, so you want to ensure you aren’t overpaying for future growth. This is because even a fantastically performing series of businesses can disappoint if all their future performance is already in the price. However, the flip side is also true – businesses that may have more questionable future cashflows may be extremely attractive if you can buy them below their long-term price. So, we don’t have a particular ‘style’ of investing, and don’t consider ourselves ‘bulls’ or ‘bears’ – we just want to pay a fair price (or preferably below fair price) for assets as the opportunities present themselves – we don’t mind where those opportunities come from, we just want to find them. In fact, our largest long-term ‘style bias’ in global equities has been to ‘Quality’ – an area heavily exposed to US Tech which has benefitted accordingly so far this year. We just think the price is too rich at the moment, and has been since 2021.

Putting quality aside, the particular areas of the market mentioned above appear to be presenting an ‘asymmetric payoff profile’ – that is, some downside protection with more upside potential under multiple different potential market outcomes. If the US economy is indeed more fragile than we believe headline numbers suggest, inflation proves to be stickier than many are forecasting and/or the Federal Reserve doesn’t cut rates the way share markets seem to expect, these same sectors, style and regions are priced such that they should provide some downside protection relative to broad market indices. However, if we are wrong on all these fronts, these are also likely to be the areas more likely to benefit from a more broad-based rally. Yes, it is possible that the 7 largest businesses in the US that have driven the majority of performance this year could continue to be the market leaders, but 2022 showed how fragile that assumption can prove when their starting price is high (which it was towards the end of 2021 and remains elevated now). The probability that they will be the leaders in a future sustained rally is not zero, but it is lower than a more broad-based rally benefitting these other sectors and regions.

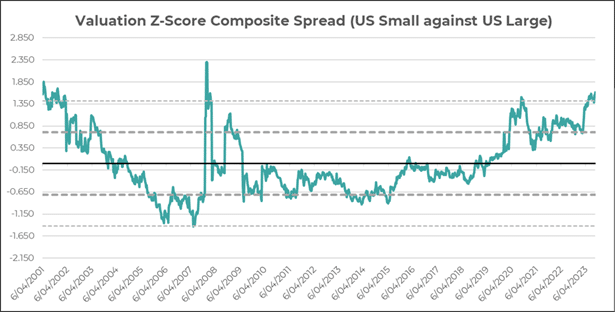

Even the small cap sector may prove to be an attractive area for the astute investor. Whilst our base-case is still that there is unrecognised fragility in economies and equity markets, we aren’t allocating to the area. However, year-to-date the iShares Russell 2000 ETF IWM has only appreciated 4.3% against the S&P500’s 15.7% price increase (to 18/09/2023), but as the chart below shows, the disparity in valuation between US small and large companies is at an extreme level (last seen in the Tech-bubble, the beginning of the GFC and post-COVID):

Source: Bloomberg, Innova Asset Management

Investing robustly is a process of calculating probabilities, recognising that you can’t forecast the future perfectly and therefore be humble in portfolio construction and try and stack the odds in your favour. You will make mistakes, but following this process should help you get more right than wrong, and manage risk far more appropriately. However, it does mean doing something different to the rest of the market. But as the great Howard Mark’s says, “You can’t get a different result doing the same thing as everyone else”.

So, keep an eye on valuations (or the price you pay), consider multiple scenarios and be prepared to look in places that others aren’t looking. It takes a lot more work, and can be uncomfortable for periods of time (it’s always more comfortable moving with the herd), but you may be able to uncover investments that could provide superior potential outcomes in an array of scenarios – as opposed to betting on a single outcome going one way or another. We think the areas we’ve outlined here offer such an opportunity at present.

[1] As we’ve stated, we think this is highly unlikely. Rate cutting is stimulatory, and if employment remains robust whilst inflation is under control whilst economic growth remains positive, it seems very unlikely Central Banks would risk a second wave of inflation by stimulating the economy when everything is looking fine.

[2] Year to date, the IUHC iShares S&P500 Health Care Sector ETF has retreated 2.2% versus the S&P500’s price appreciation of 15.7% to 18/09/2023

Quarterly market update | Q2 2024