2023 began with substantial optimism for economies closely intertwined with China’s reopening, particularly in light of the expected relaxation of monetary policy. This optimism stood in stark contrast to the prevailing pessimism of slowing growth and restrictive monetary policy in developed markets, which created a nice narrative. We now know six months later that the reopening did not ignite the economic resurgence that many investors had anticipated, though is it as bad as headlines are suggesting?

In July and August, several factors contributed to a decline in confidence and pessimistic headlines. These include the initial signs of deflation, concerns about “youth” unemployment, and heightened apprehensions regarding ongoing issues in the troubled property sector. Whilst there are certainly alarming trends, there are components that have been missed in the bear narrative, which paints a slightly brighter picture for China.

It’s important to recognize that the post-lockdown economic recovery was anticipated to rely more on consumer spending rather than the traditional government investment initiatives seen in previous economic cycles. Nevertheless, there appears to be a problem of misallocation of resources in the investment-driven growth approach, which could result in China facing a challenging and disruptive debt restructuring process. It is crucial to acknowledge that a continued dependence on boosting the property sector and channelling resources into infrastructure projects may not offer sustainable, long-term economic growth. This unsustainable approach to government-led growth is well-documented in China, where only 34% of the total GDP is derived from domestic consumption. This issue could potentially become a structural problem for the nation, prompting a need to diversify away from manufacturing and exports and shift towards a more domestic-focused approach.

Source: World Bank, Innova Asset Management

The Property Sector

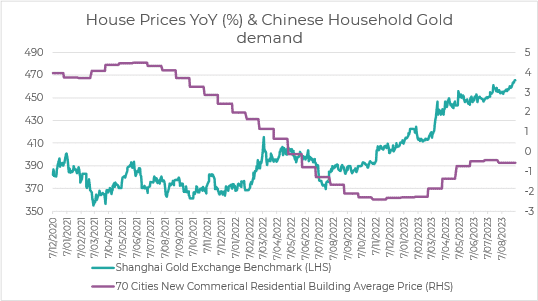

The property sector in China has been a focal point of discussions, with worries about its sustainability and potential impacts on the broader economy. Notably, the Chinese Communist party (CCP) has pledged support to this sector, but doubts persist about whether this support will suffice. As we know, Chinese households love to store wealth in property given the benefits that were reaped by doing so over the past 20 years, but that may have changed. As seen below, there’s been steady downward pressure on prices, particularly among the Tier 3 cities in China, and a shift towards gold for households as a storage of wealth:

Source: Bloomberg, Innova Asset Management

While the Evergrande default cycle in 2021 is well-documented (though they recently filed for Chapter 15 bankruptcy in New York), recent developments highlight Country Garden’s precarious financial situation. They have reported a staggering $200 billion (USD) in unpaid bills and the potential default on $340 billion in debt, all while grappling with around 1 million unfinished apartments. These substantial debts and payment defaults have attracted global attention, instilling concerns about the magnitude of the problem. Additionally, reports of property oversupply and decreasing prices have intensified these worries, potentially exacerbating deflationary concerns.

An important statistic to consider is that approximately 70% of Chinese household wealth is now tied up in real estate. Furthermore, the property sector accounts for around 30% of China’s GDP, representing a massive $62 trillion globally. However, it’s crucial to note that many of these challenges are concentrated in China’s “Tier 3” property market, where supply has significantly outpaced demand. A staggering 60% of China’s national GDP is attributed to these Tier 3 property developments.

To address these issues, the Chinese government has responded with loosening monetary policy, backtracked on their “3 Red Line Rule”, after seeing slower growth, deflation, and to allow banks roll out loans to help the developers. The effectiveness of these policies remains a subject of debate, given the sheer scale of damage that has already been dealt.

Deflation and Growth

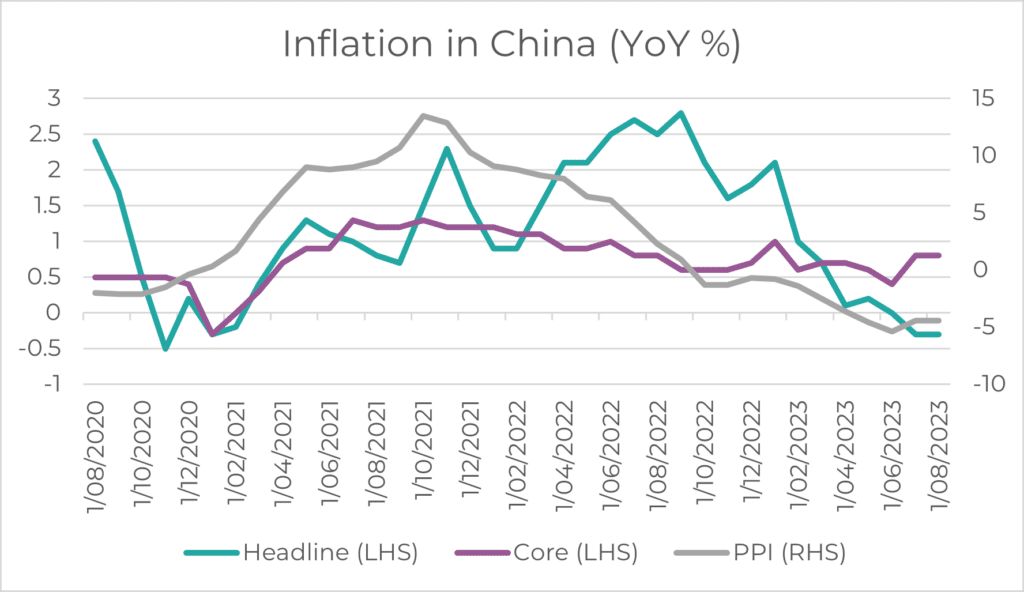

Source: Bloomberg, Innova Asset Management

Whilst we did see the first print of -0.3% in CPI numbers, core inflation actually surprised 0.8% up in July (negative in 2021), which many headlines failed to discuss. Clearly, Chinese consumers are being cautious with their savings which can be attributed to factors including the income volatility endured during the extended 2–3-year lockdown period and the inherent instability of the real estate sector, where a substantial portion of the average household’s wealth is tied up. Its clear current stimulus was unable to boost consumer and business sentiment. Besides, the deflation coming from China is not being driven from an increase in production capacity (e.g., supply driven), but rather weak consumer demand. This is made worse by the high debt burden in China, too.

Source: Bloomberg, Innova Asset Management

In this cautious regime for Chinese households, as money becomes more valuable (because deflation causes prices to drop), current demand will fall (consumers anticipate price falls, and so wait to buy things), which may in turn cause companies to scale back and produce less. On a more global scale, weaker foreign consumer demand from China to the US or Europe may actually allow those developed markets to feel the deflation too – with 13% of revenues from the largest 200 multinationals in developed countries coming from China.

Source: Bloomberg, Innova Asset Management

Retail sales were positive and increasing after an awful 2022 but are also in a negative trend after the April numbers, another indicator of weaker demand and a willingness to save.

Source: Bloomberg, Innova Asset Management

The purchasing manager index (PMI), which measures the direction of the manufacturing industry, continues to be in a contractionary state (above 50 is expansion, below 50 contraction), but has been contracting at a slightly slower rate in recent months.

Source: Bloomberg, Innova Asset Management

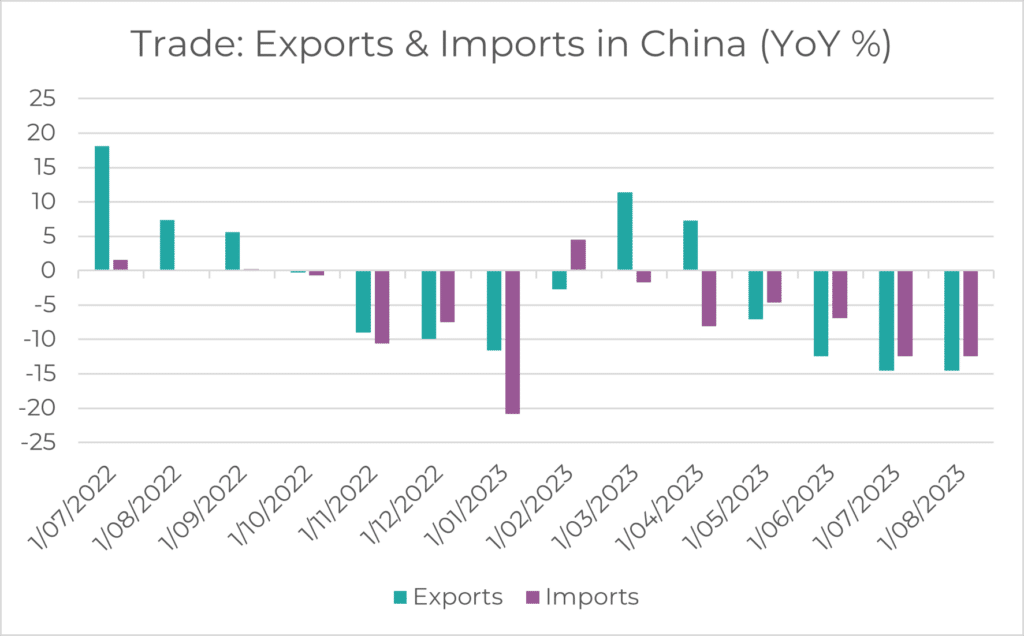

China is grappling with declining imports and exports, as well as a sharp -80% year-over-year plunge in foreign direct investment inflows during the second quarter. Given 40% of China’s GDP is accounted for by trade, this is certainly concerning, and investors may be questioning whether this is where it bottoms out.

Source: Bloomberg, Innova Asset Management

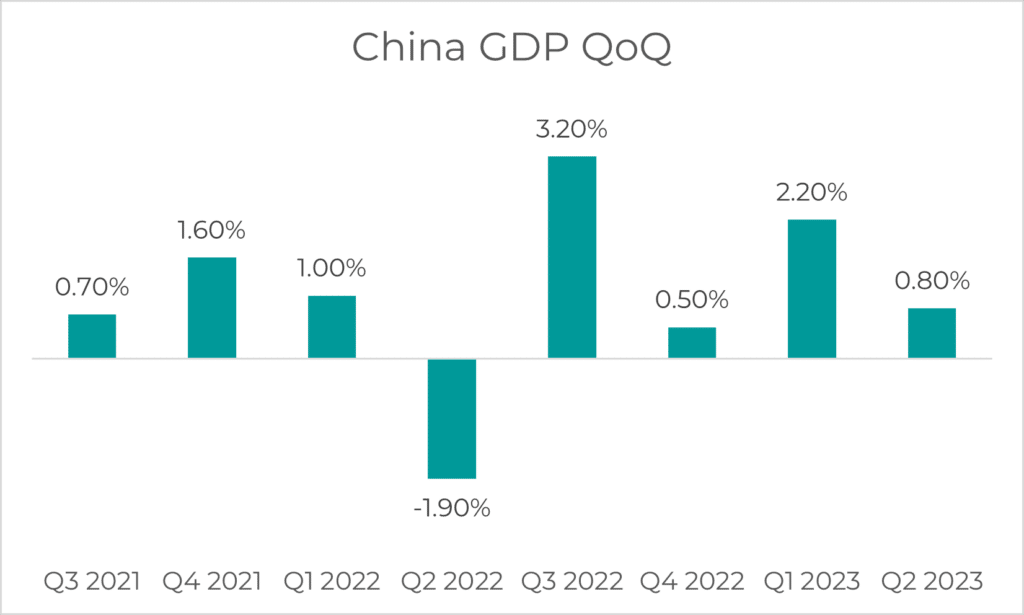

GDP was up 0.8% in the June quarter, which given the circumstances on the manufacturing, trade, and consumer spending front, doesn’t seem horrific. GDP forecasts have remained somewhat steady for China overall as reported by Bloomberg, though the current quarterly numbers are struggling to be on path to meet the 5% target set by the government for 2023.

Unemployment

It’s important to note that whilst the headlines were flooded with the “Youth Unemployment Rate” being 21.4%, and the CCP deciding to discontinue that statistic, this includes 16–26-year-olds. The unemployment rate of 25–59-year-olds is at 4.1%, its lowest since COVID, and arguably more indicative of an overall economic picture and active workers.

Source: Bloomberg, Innova Asset Management

Geopolitics

Given it’s the area of focus, we must include geopolitics and political risk. It’s clear government intervention into corporate affairs is a risk associated with investing in China, as seen in the online education, e-commerce and other tech sectors. Clearly this poses a risk to portfolios – which the West has been voiced via further onshoring, shifting of supply chains and the decline in foreign direct investment. Of course, China’s ties with Russia during the Ukraine conflict may have further developed those tensions with Western nations and compounded the de-risking.

We’ve also seen a meaningful downtrend in the Yuan since early 2022 coming from interest rate differentials due to higher inflation and policy rates in developed markets. This has inherently hurt the spending power of the Chinese, though may have helped boost exports since. In the long-term however, given the CCP want to advocate for the Yuan as a more focal currency on the global scale, there is a real challenge being faced:

Source: Bloomberg, Innova Asset Management

Investable?

Although there are indeed domestic concerns, including potentially fragile segments like the property sector and government-intervened industries, adopting an active approach within the region can uncover attractively priced opportunities with strong fundamentals. The valuation of the MSCI China Index currently resides at a multi-decade low when compared to its historical levels and in relation to developed markets:

Source: Bloomberg, Innova Asset Management

Overall, investors should closely monitor the developments in the property sector in China, as well as government intervention and policy decisions which will ultimately dictate the fate of the economy. There are mixed signals from the rest of the economy, with a slight pickup in manufacturing, though the exports and consumer spending patterns are not very supportive of future growth currently. The risk of deflation’s wider effect on a country with a high debt burden should also be very closely monitored.

However, all this must be thought about in the context of the price being paid for an asset. When investing in the equity market, you are buying businesses (and the rights to their future cash flows), not an economy, and equity returns may be poorly explained by economic growth (or lack of growth). When investing in the equity market, you are buying businesses (and the rights to their future cash flows), not an economy, and equity returns may at times poorly explained by economic growth (or lack of growth). The current price for many of China’s best-run businesses are being dragged down by macro-economic concerns, which could present an excellent opportunity for the qualified active investor. As we have mentioned previously, one of Innova’s core investment principles is that the price paid drives long term return – almost any asset can be attractive if picked up at the right price, China may be offering a good long-term opportunity for those who know the region and its businesses well.