Equities have outperformed default MySuper funds but not all equity options are created equal

The average equity portfolio has outperformed its default balanced super fund rivals over decades but that doesn’t mean all equity portfolios are guaranteed to be strong performers.[1]

Equities are far more volatile and can also have long periods of underperformance. But over very long periods, they tend to deliver higher returns which compensates investors for taking on this risk.

However, even with an all-equities approach, there are smarter ways to manage volatility and occasionally large drawdowns, than a simple market-cap weighted indexed equities approach.

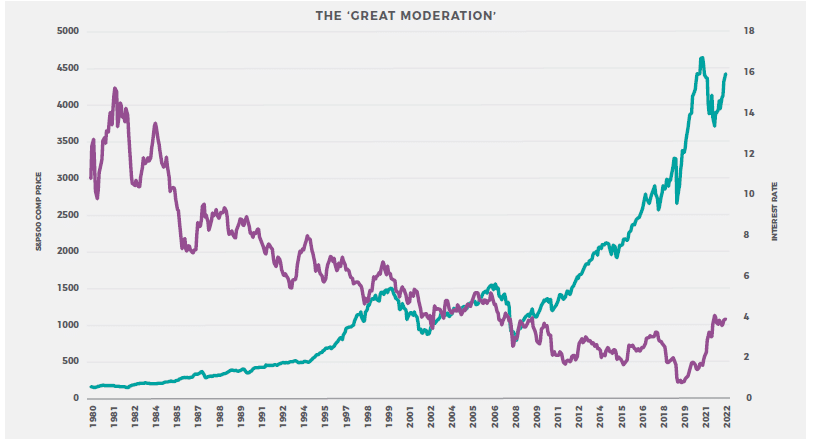

It is even more important now that the era of ultra-low interest rates appears to be over. From 1995 rates were static (the Great Moderation) and then started falling towards zero from around 2013 until 2022 (post the Global Financial Crisis and including the COVID-19 crisis).

It provided a massive tailwind for equities and long duration bonds, but in this new environment, investors will have to be more active to drive returns.

Source: Bloomberg, Innova Asset Management

Focus on the equity fundamentals and drivers of return

Few investors have 10-plus year investment time horizons or are willing to endure the higher volatility and larger drawdowns often associated with equities.

Younger Australians’ super, which is locked up for decades, is one of the few situations where there is a great match (yet too many are still invested in MySuper defaults – see our last Insight for a deeper analysis).

When a higher-growth investment strategy such as equities matches an investor’s goals, they still need to manage the extra risk that comes with it.

This is something that investors expect from their active managers, yet there is strong evidence that the performance of even the best active managers doesn’t persist over time.[2] We call this type of outperformance ‘naïve alpha’. What is going wrong?

All investors focus on some type of fundamental characteristics when investing, such as ‘value’ or ‘growth’ (or even market cap for passive managers). There is increasing evidence to suggest that these factors are the key driver of outperformance or alpha, including for active managers (although they may not be identifying it).

In fact, there is evidence that factors explain around 90 per cent of fund manager return variability and the way that their performance wanes over time.

The impact of valuation and momentum factors

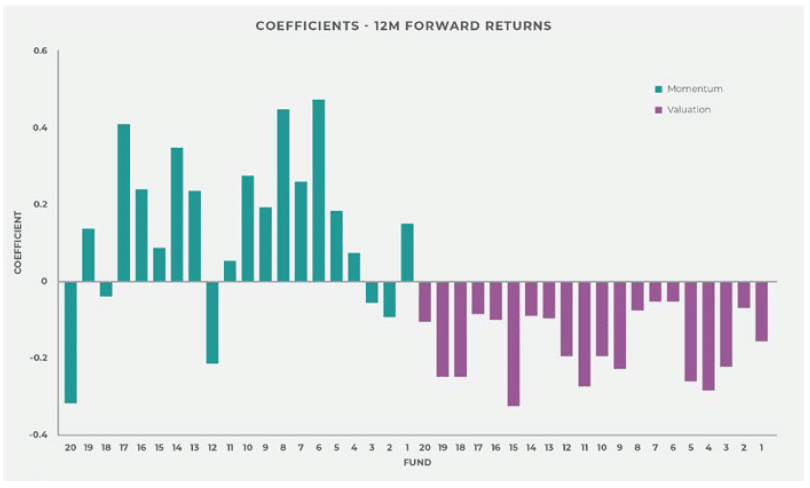

An Innova analysis of more than 100 Australian equity managers shows the impact of two of the strongest factors – momentum and valuation – on performance. It also helps explains why most active managers don’t deliver consistent alpha over the long term.

The diagram below shows the impact of one-year past performance (higher past performance suggests strong momentum) and five-year past performance (higher past performance suggests the valuation is becoming more expensive) on fund manager performance.

Most fund managers show a positive relationship with momentum and a negative relationship with valuation.

Source: Morningstar, Innova Asset Management

A better understanding of these factors (including others such as company size, quality, and volatility) can identify those fund managers delivering naïve alpha and help investors avoid paying active fees for a simple style bias that may be out of favour. In many cases, an investor may be able access this same factor at a lower price.

Some investors take a static approach to investing via factors, with common debates centring on styles such as value versus growth.

However, we believe there is merit in rotating into and out of these factors as market conditions change to suit them. Factors that have performed well over the last few years will still likely cycle back to underperforming over the medium term.

The challenge is to understand why and then implement this factor rotation in a systematic, rules-based fashion. This approach is one of Innova’s key competitive advantages, and we continue to research and refine our approach to delivering factor-adjusted alpha rather than naïve alpha.

This can help equity investors (as well as those investing in other asset classes) extract the most outperformance from their strategy.

[1] Portfolio Insights | Young investors lose by leaving savings in default MySuper funds | Innova Asset Management. Retrieved from https://innovaam.com.au/portfolio-insights-young-investors-lose-by-leaving-savings-in-default-mysuper-funds

[2] ASIC Report 22: A review of the research on the past performance of managed funds. September 2002 – (revised June 2003). Retrieved from https://download.asic.gov.au/media/1337666/FMRC_Report.pdf.