All data, tables and charts’ sources are Bloomberg, Innova Asset Management

Quick review of 2025

2025 began with a sharp increase in volatility, driven by tariff plans announced by the new Trump administration in April. While this initially unsettled markets, conditions improved as the year progressed and equity markets finished the year strongly. Throughout the recovery, tariff uncertainty slowly dissipated and the transmission to inflation was light. However, a very large proportion of US growth came from AI investment, a major theme of 2025, which raised questions over the true underlying growth of the US economy.

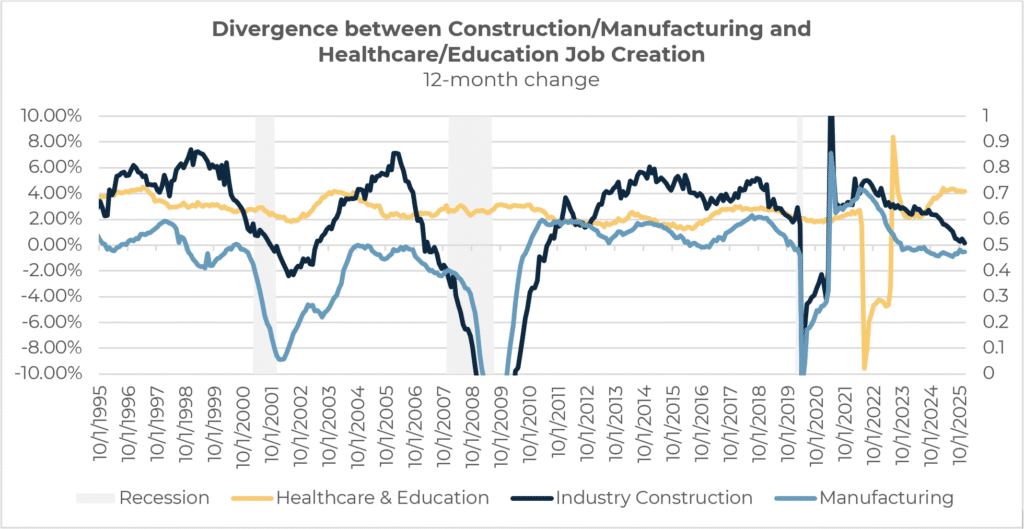

Overall, global economic conditions gradually became more supportive, characterised by falling inflation (though stubborn in places), easing monetary policy, expansionary fiscal settings, a slowing labour market, and moderate but resilient growth. Markets were also dominated by enthusiasm around AI as a driver of productivity and earnings growth, but this increasingly came with scrutiny around valuation, concentration risk, and reliance on a narrow set of companies to deliver market-wide progress. A more pronounced K-shaped economy persisted, with growth outcomes looking increasingly fragmented between AI-linked and non-AI segments, reinforcing the divide between cyclical and non-cyclical parts of the market. It’s clear from data that the more cyclical areas such as housing and manufacturing are struggling, evident in the jobs data which show a large proportion of jobs added coming from healthcare and government services and an asymmetry between high income earners and lower-to-middle income earners. High income earners continue to be fuelled by the wealth effect of rising asset prices, whilst the lower-to-middle income earners are surviving on credit card debt and government handouts.

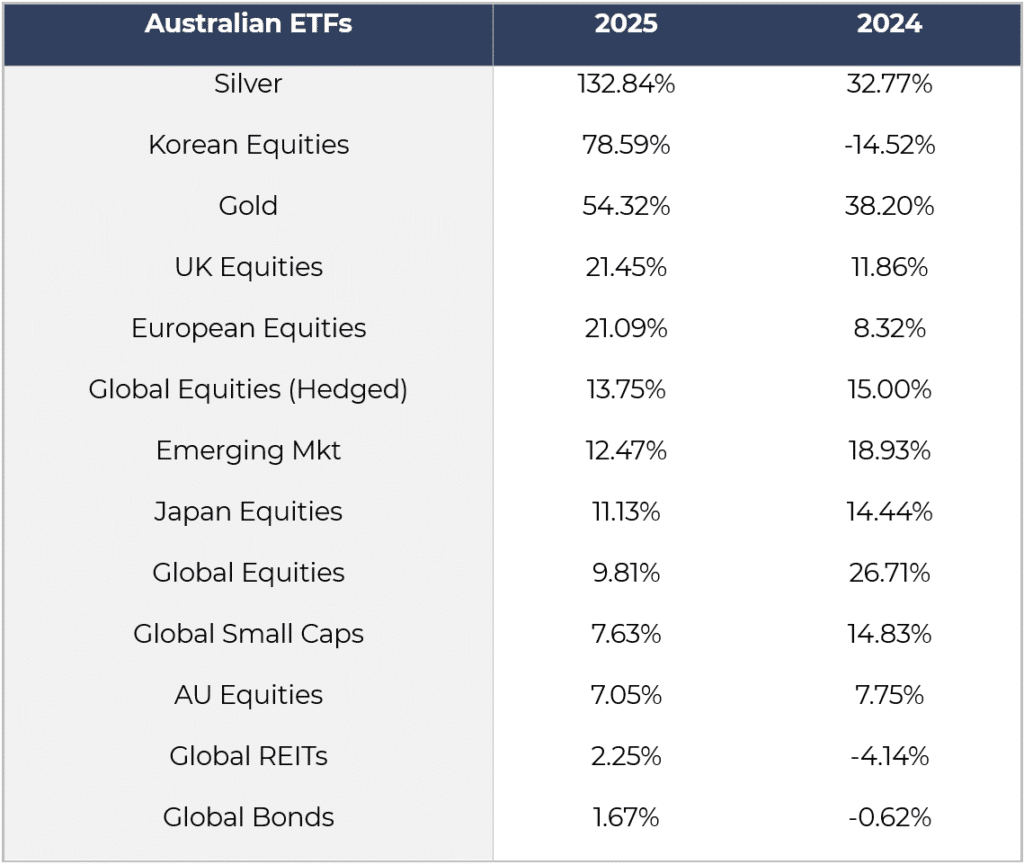

Total Returns:

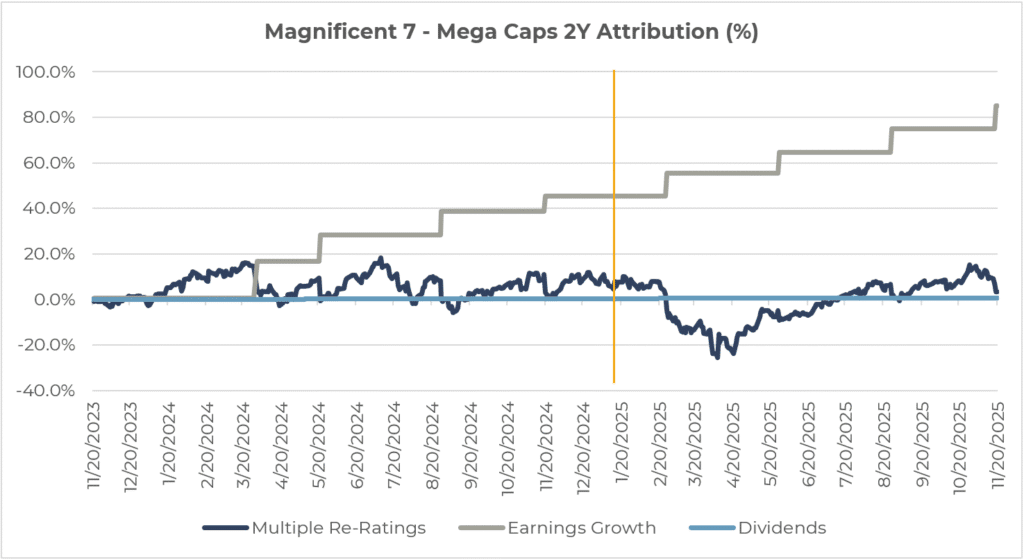

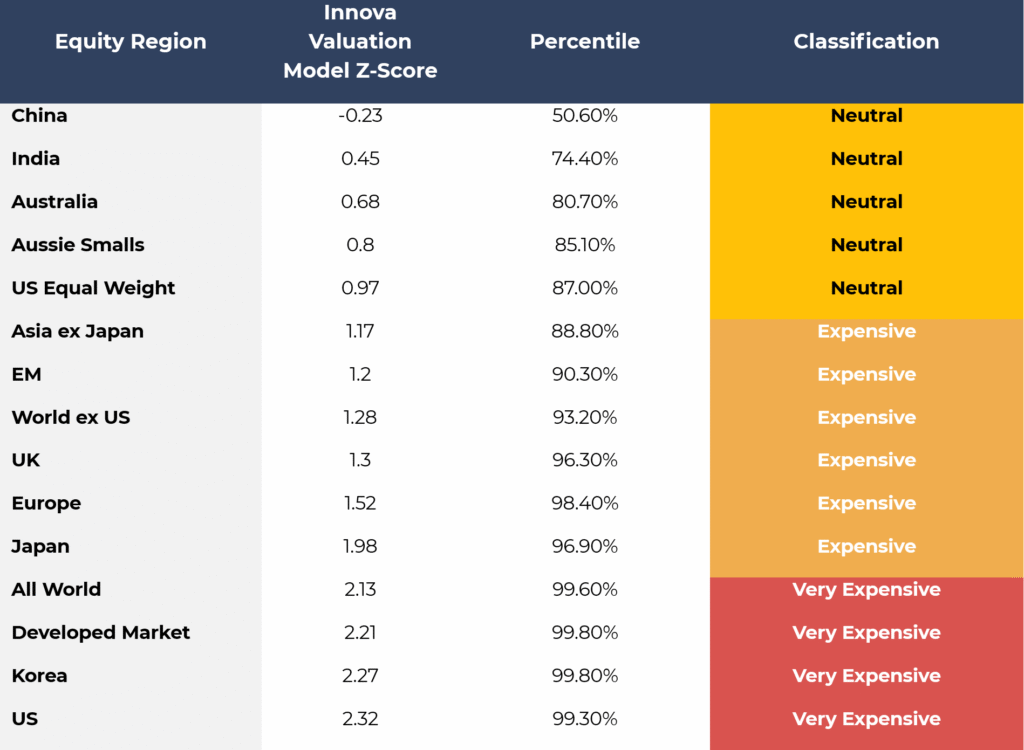

Encouragingly, the rally broadened out over the year. Emerging markets, value equities, and select regional equity markets such as Korea were among the standout equity performers. Small- to mid-cap AI themes also began to catch up with their large-cap counterparts. Many outperformers entered 2025 with relatively low starting valuations, allowing them to close the gap on segments that were already richly priced. The Magnificent 7, which delivered strong earnings growth, did not experience an upward re-rating in valuation multiples due to the high starting points.

In fixed income, bond market volatility declined, but divergence persisted across major markets, and the correlation to equities did not reliably shift back to negative, tempering confidence in bonds as a consistent hedge in this regime. Credit spreads tightened back toward cycle tights across investment grade, high yield, and emerging market debt, leaving returns more carry-driven with limited upside if spreads remain compressed. In currencies and commodities, gold and silver benefited from geopolitical uncertainty and sustained central bank buying, while a weaker US dollar supported commodity-linked and emerging markets and helped underpin strength in AUD/USD. Commodity performance was mixed overall, but looking ahead, geopolitical tensions, rising global debt levels, and inflation uncertainty may continue to provide support to commodity-exposed assets through 2026.

Looking to 2026

Our view

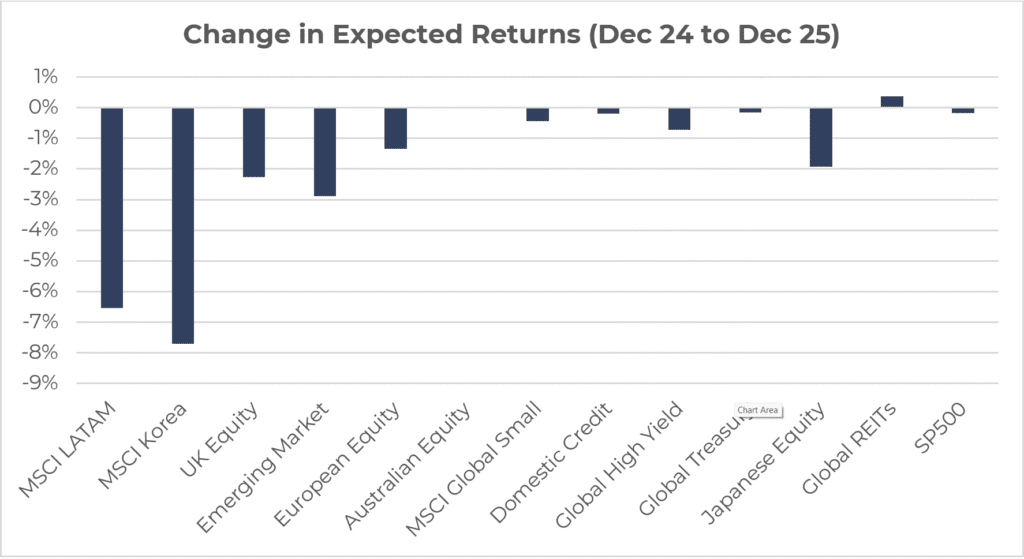

As we move into 2026, macroeconomic uncertainty has eased relative to 2025, but this comes alongside lower expected returns and a higher degree of risk embedded in asset prices. Starting valuations across many asset classes remain elevated, meaning the compensation investors receive for holding risk assets has compressed. While the macroeconomic environment is broadly supportive, prices across most assets are starting at quite high levels, leading us to adopt a more selective and cautious approach to portfolio construction. Most developed economies remain in an expansive fiscal and monetary stance (aside from Japan), while geopolitical risks remain elevated.

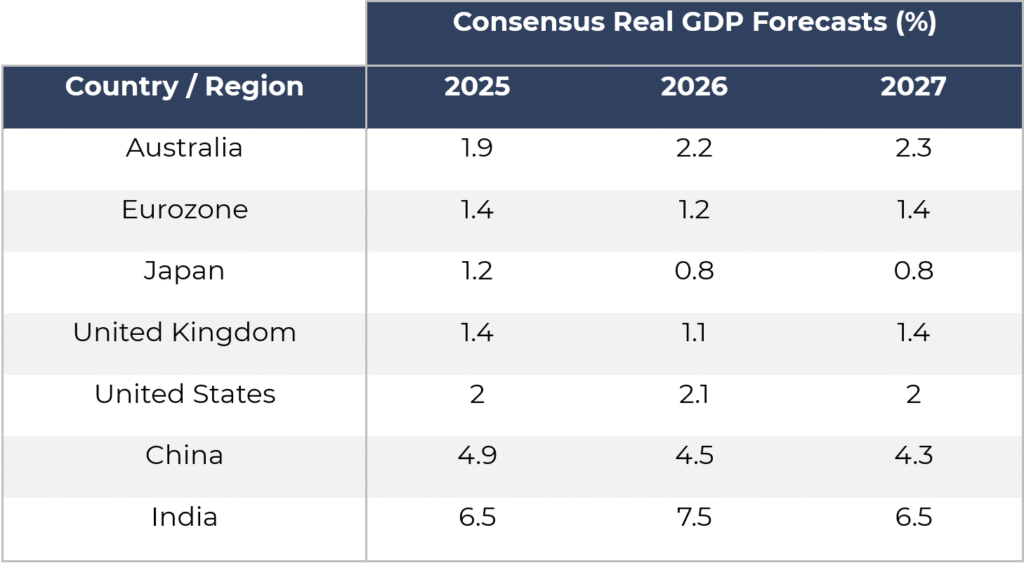

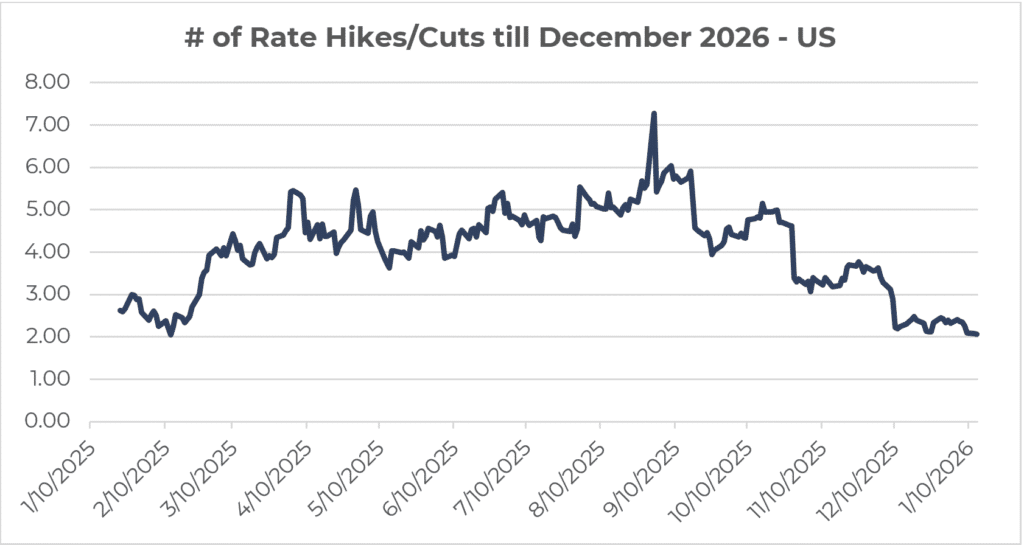

From a macro perspective, the global economic growth backdrop remains constructive. Most major economies continue to operate under highly expansionary fiscal regimes, and global money creation is expected to remain strong through 2026. Large fiscal programs in the US, Europe and parts of Asia, combined with sustained AI-related capital expenditure, are driving a meaningful nominal growth impulse. Central banks are unlikely to actively counter this dynamic, with policy is expected to remain neutral or ease modestly, supported by slowing but still sticky inflation and impact on goods from tariffs.

This policy mix is supportive of risk assets in aggregate, particularly those with shorter-duration cash flows and lower sensitivity to inflation and interest rates. In contrast, longer-duration assets and parts of fixed income remain more exposed to fiscal uncertainty and elevated term premia. Housing disinflation, especially in the US, is expected to help keep core inflation contained around the 2.5 to 3.0 percent range, allowing central banks to remain accommodative without risking a sharp inflation reacceleration.

Despite this supportive backdrop, valuation remains a key constraint. Equity markets in many regions are priced for strong outcomes, increasing the risk of earnings disappointment if growth slows or margins compress. The S&P 500 (and, to a lesser extent, the MSCI World) has increasingly become a large and concentrated bet on AI. Around 40% of the S&P 500 is now represented by its top 10 stocks.

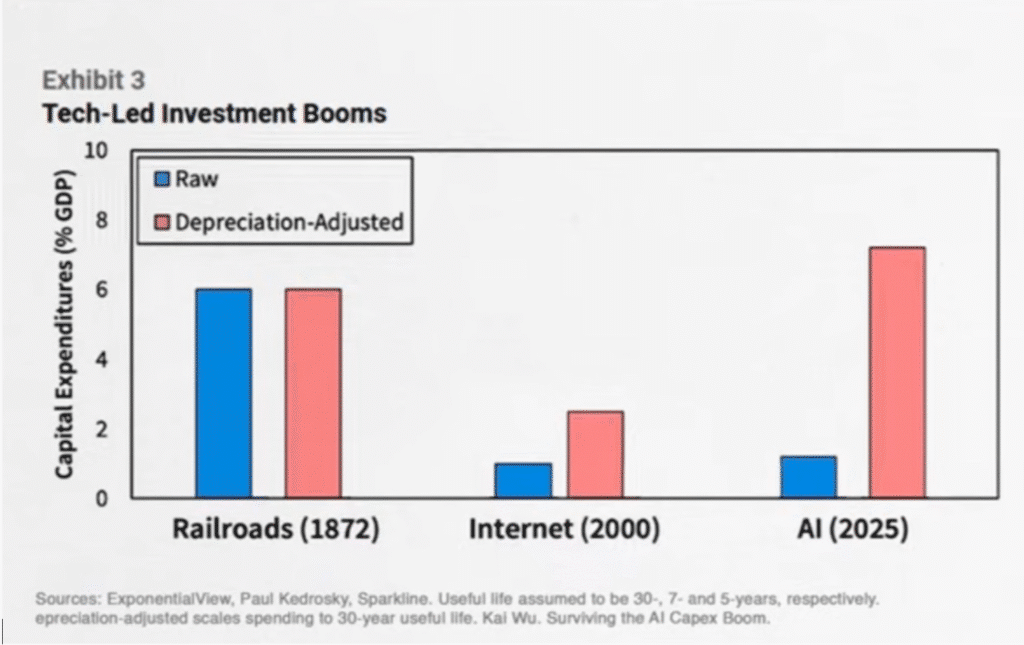

At the same time, many of the most richly valued AI-linked companies are pouring extraordinary sums into data centres and related capex, in what is increasingly a geopolitical “arms race” with China. That investment push sits atop a fragile, highly concentrated supply chain—dependent on a small number of critical players such as ASML (Netherlands) and TSMC (Taiwan).

A key risk that’s still underappreciated is the true scale of this capex once one accounts for more realistic asset lives. Chips, GPUs and associated infrastructure depreciate far faster than long-life assets like railroads (a comparison investors often reach for), which means headline capex can materially understate the effective “economic” reinvestment burden required to stay at the frontier.

See below for capex as a share of GDP, adjusted for more realistic depreciation assumptions:

This raises the importance of differentiation within equities, favouring companies with pricing power, balance sheet strength and genuine productivity gains, while reducing the appeal of broad, valuation-insensitive exposure. As a result, we expect greater dispersion across sectors and styles rather than uniform market-driven returns.

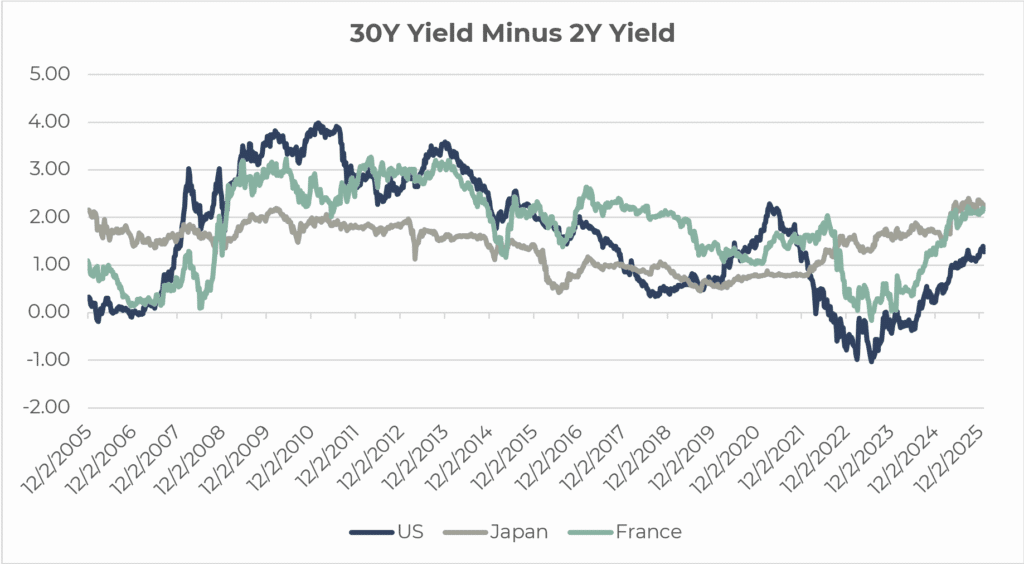

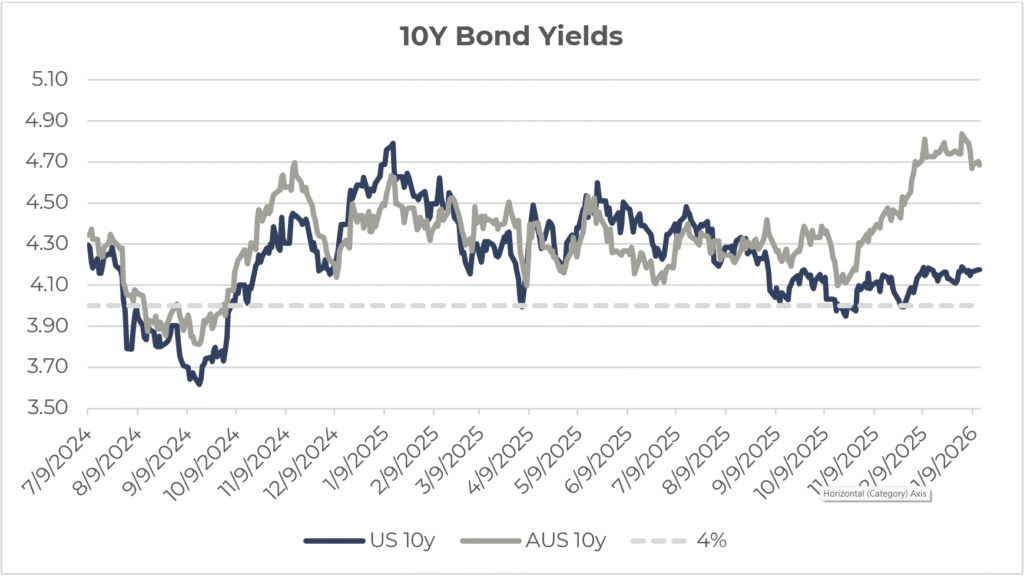

A defining theme for 2026 is rising fiscal uncertainty and its implications for bonds, currencies and real assets. Persistently large government deficits are likely to keep long-end yields elevated, limiting the defensive properties of duration-heavy fixed income. This environment favours a more selective approach to bonds, with a preference for income, flexibility and shorter-duration exposures over traditional long-duration government securities. At the same time, ongoing concerns around sovereign balance sheets and policy credibility are likely to support demand for real assets and inflation-resilient exposures over the medium term.

In the US, growth remains resilient but increasingly uneven. Cyclical sectors such as housing, credit and parts of commercial property have softened, and hiring among small and mid-cap companies has slowed materially. Labour market conditions weakened through 2025, with repeated earnings downgrades reinforcing the “low fire, low hire” narrative. Consumption has remained relatively resilient, though increasingly supported by credit rather than income growth, which warrants close monitoring from both a growth and credit-risk perspective.

Political and policy risks remain elevated. The conclusion of Federal Reserve Chair Jerome Powell’s term in May 2026 may introduce volatility in fixed income and currency markets, particularly if a more overtly dovish successor is appointed. The full rollout of the “One Big Beautiful Bill” through 2026, encompassing deregulation, corporate and household tax cuts, and an end to quantitative tightening, is likely to support near-term growth but adds to longer-term fiscal pressures. The November midterm elections further increase the likelihood of episodic market volatility and tactical corrections.

Inflation dynamics remain regionally divergent. In the US, inflation has stabilised around 3 percent, with tariffs having a more muted impact than initially feared and low oil prices helping to anchor inflation expectations. We do not expect a return to the inflationary conditions seen in 2022. In Australia, inflation has proven more persistent, driving a divergence in monetary policy paths relative to the US. While this creates more attractive yield opportunities in Australian fixed income, we remain cautious given the economy’s sensitivity to interest rates and the continued tightness in parts of the labour market.

Overall, our base case for 2026 is one of moderate global growth, a recession highly unlikely (but something unexpected could occur – particularly with Donald Trump in charge of the White House) and inflation that remains manageable but sticky. Expansionary fiscal policy, accommodative monetary conditions and ongoing credit creation continue to support nominal activity which should flow into the recovery of unloved cyclical segments of global equities. However, elevated valuations, fiscal uncertainty and uneven productivity outcomes suggest multiple expansion on expensive areas such as US mega caps will be difficult.

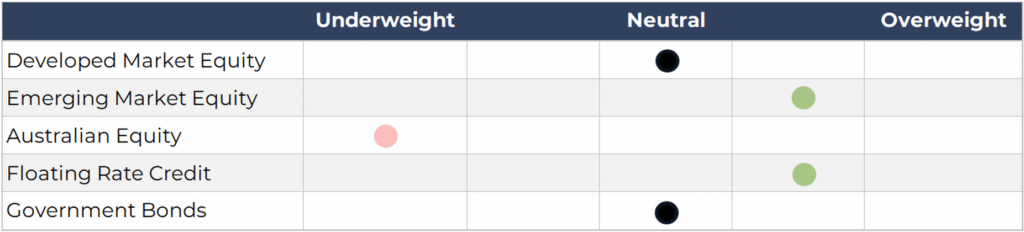

We are overweight emerging markets, quality small caps, international value, UK equities and underweight US mega caps, Australian equities (especially the banks) and long duration treasuries.