Residential property has created unprecedented wealth for Baby Boomers thanks to the power of leverage, lucrative tax breaks, constrained supply, and strong population growth.

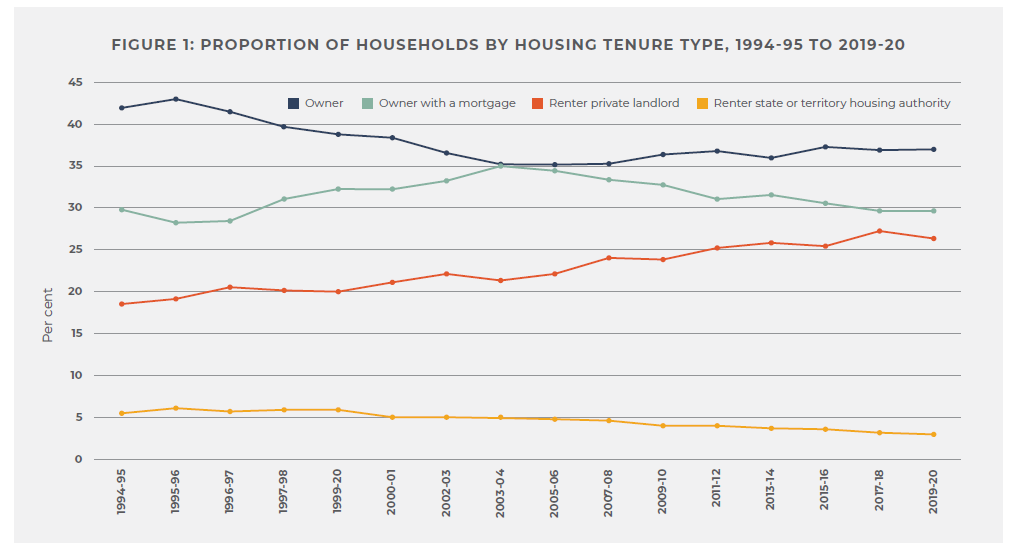

Unfortunately, a generation of younger Australians have become the collateral damage. Many who can’t rely on parental wealth or an inheritance have been effectively locked out of the market.

This has deep implications across many areas of society. Younger Australians are in desperate need of solutions, but it seems there are no politically simple ways to tilt housing back towards being a human right rather than a speculative asset class.

There will always be sound reasons to own a home that stretch far beyond the financial realm, but many younger investors will also need to consider new ways to accumulate wealth.

How leverage drives property returns

A range of factors have driven residential property prices higher but one is rarely given its due: leverage.

Loan-to-valuation ratios regularly stretch beyond 80 per cent (where lenders’ mortgage insurance starts) while some governments have backed schemes allowing up to 98 per cent of a property’s value to be borrowed.

That amount of debt can turbocharge even nominal price gains given the median house in Sydney is now valued at almost $1.4 million.

The median house price 40 years ago in 1984 was $64,039[1], compared to the combined capital city median in 2024 of $949,410[2]. This represents an annual growth rate of 6.97 per cent p.a.

Given interest rates over the period, this represents roughly the return you’d have received if long term bonds were available to buy in Australia. However, if we assume a 20 per cent deposit was put down, this deposit is $12,808.

Now assume no capital (i.e. none of the $51,231 borrowed) was paid off, only interest. Forty years later the homeowner would have had $898,179 of equity capital in their home ($949,410 less the $51,231 borrowed) – a whopping 11.21 per cent annual return before costs and interest. We haven’t included interest costs here as we are trying to (in a simple way) to demonstrate the power of leverage. The interest costs on $51,231 start to pale in comparison to the value of the equity in the home over 40 years.

We can see the power of leverage in the growth of their equity capital in the home, taking an asset that provided bond-like returns into much higher equities-like returns.

That leveraged door has now closed for most younger Australians. A conservative deposit on an average Sydney home (20 per cent) is well above $300,000 after including stamp duty and other transaction costs. Forty years ago a home cost 3.3 times annual income on average, it’s now closer to 10 times.

So even though interest rates are lower, affordability is meaningfully worse.

It’s no surprise that the next generation is turning to more accessible investments such as shares and even cryptocurrencies.

Housing, super, and retirement: new ways of thinking

Australia’s retirement system is built on housing, private savings (super), and the Age Pension. The interaction between these three pillars creates one of the most complex systems in the world.

With home ownership out of reach for many, it’s no surprise that super is gaining more attention in the retirement mix.

The (usually substantial) value of a retiree’s home isn’t included in the Age Pension means test. Unfortunately, the value of rent assistance for non-home owners isn’t nearly so high, which consigns many renters to a life of poverty in retirement.

The Liberal party is (controversially) considering ways that super can be used to pay for housing,[3] but there may be other ways to bolster super’s role in retirement given it will likely become the largest asset for many younger Australians.

As we have seen above, leverage powers residential property returns. Once leverage is removed, equity returns often outperform residential property over the long term on a pre-tax basis The problem is equities can’t be leveraged to the same level given daily pricing leads to much higher volatility (and potentially margin calls). In addition, equities have distributable income that is taxable and don’t have the CGT exemption that the family home has. However, add in the interest cost of buying a house today at 10 times your annual income and suddenly those tax outcomes aren’t as relevant.

Meanwhile, there are strict rules that prevent super funds from using leverage. Perhaps it’s time to reconsider those rules given the super system has been established for decades.

Super is a 40-plus year investment where volatility – amplified by moderate leverage – can be managed. Most funds have met their long-term return goals: leverage could power up that wealth.

The average super fund has posted a 7.3 per cent annual return (or a real return of 4.5 per cent) over the 30 years ended June 30, 2023, according to ASFA. The scale of super funds means they could borrow at very low cost. Applying a moderate amount of leverage combined with a greater allocation to equities or a more aggressive investment profile should generate similar or greater return than a leveraged property investment.

It may not be enough to solve the housing crisis on its own, but it deserves further consideration as a generation of young Australians face a long wait for political solutions to the current housing crisis.

The common saying that ‘your home will be your largest investment’ may need a recalibration, with super potentially being the biggest asset future generations will have.

[1] Source: Finder.com.au; https://www.ausstats.abs.gov.au/ausstats/free.nsf/0/515E8542EFCC679ACA257A10001876D5/$File/56090_11_1984.pdf

[2] https://www.corelogic.com.au/__data/assets/pdf_file/0028/21979/CoreLogic-HVI-Mar-2024-FINAL.pdf

[3] An ABS survey from 2012-13 – when housing pressures were less severe – found that one-quarter of retirees were already using super lump sums on housing, such as paying off their mortgage. Productivity Commission report: https://www.pc.gov.au/research/completed/superannuation-post-retirement/super-post-retirement-volume1.pdf.