Exchange-traded funds (ETFs) have revolutionised the Australian funds management sector since the first index fund was launched almost 25 years ago.[1]

Today there are a dizzying array of more than 380 ETFs trading on the ASX which collectively hold more than $200 billion in assets.[2] Global ETF assets have climbed to more than $US11.5 trillion.[3]

Many of these ETFs have increased the ability of investors to create more tailored portfolios but many are also just following market sentiment and media hype.

They may offer the illusion of outsized investment returns, but in reality they’re often chasing themes where any gains have already been built into the price.

Specialised thematic ETFs: look under the hood

There was a similar ETF boom just prior to the Global Financial Crisis in 2007-08, but many of these products failed to reach a critical mass and were closed when markets plunged over the following years.

The boom is back today. Many of the latest trends are wrapped in new ETF products. Some of these areas may become important to the economy but that doesn’t mean buying ETFs focused on these areas will automatically lead to longer term outperformance.

For example, ETFs focusing on companies in the new crypto and metaverse sectors tap into rising public and media interest, but these themes don’t convey the factors[4] driving their price or the underlying investment risks.

A closer analysis of the underlying companies within these two ETFs shows they both have a heavy growth bias. A heavy growth strategy tends to underperform over the long-term because it’s valuation (price) that drives long-term returns.

Just as importantly, these theme-based ETFs tend to follow investor sentiment and hype, which means any potential short-term returns have probably already been factored into the price. The price an investor pays for an asset (even a quality one) is a key determinant of any long-term realised gain. The launch of a specialised, thematic-based ETF is often a contrarian indicator that the theme has already peaked.

Meanwhile the fees attached to such specialised ETFs are often high – in this case almost 0.70 percentage points a year, which is well above a pure growth factor ETF such as the Vanguard Russell 1000 Growth ETF (VONG) and its 0.05 percentage point fee. The table below shows a comparison of both ETFs “factor scores”. The table illustrates the ETFs’ exposures to lower quality, expensive stocks, which in the long-term leads to lower risk-adjusted returns (a t-Stat over 2.58% or lower than -2.58% means it sits in the 99th percentile of return explanation).

| Crypto ETF | MetaVerse ETF | |||

| Fees | 0.67% | 0.69% | ||

| Beta | T-Stat | Beta | T-Stat | |

| Quality | -3.15 | -1.92 | -0.09 | -0.36 |

| Mom | 1.78 | 1.26 | -0.10 | -0.46 |

| Size | 3.33 | 2.96 | 0.27 | 1.52 |

| Value | -2.60 | -3.52 | -0.89 | -7.57 |

Source, Bloomberg and Innova Asset Management

Using ETFs and their underlying factors to build better portfolios

Traditional low-cost market cap weighted indices should still make up the core of most portfolios. It is a simple way to gain access to the equity risk premium that drives long-term returns. However, there are times when it also becomes expensive.

While many of the new thematic-based ETFs are already trading at high valuations, charge higher fees, and are driven by factors that are more efficient to access elsewhere, other ETFs offer ways to generate higher risk-adjusted returns in the right environment.

They can allow portfolios to be tilted directly to valuation, growth, momentum, quality and other factors as they cycle in and out of favour. Research shows that factors are the key driver of outperformance which accounts for around 90 per cent of active fund manager return variability.[5]

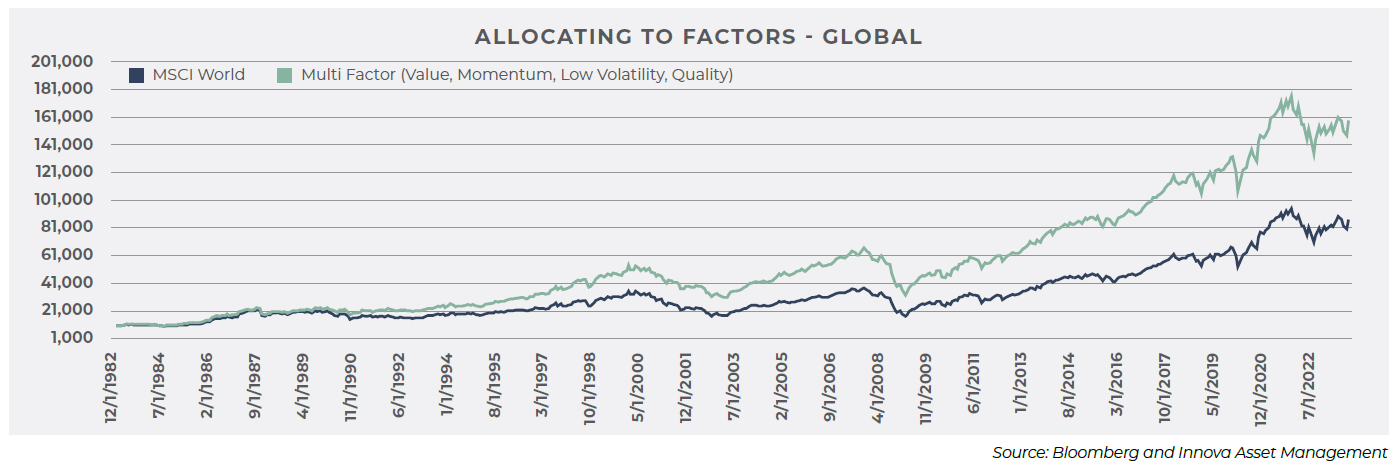

Even a simplistic monthly rebalance of a portfolio to invest in stocks with the highest value, quality, momentum, and low volatility scores shows strong long-term outperformance, as shown in the equity portfolio below.[6] There are now equity ETFs that reflect all these factors.

It takes an investment specialist to consistently manage a portfolio through changing market conditions. ETFs are a fundamental way to construct these portfolios.

However, an investor needs to understand what the underlying index is and what risks are embedded in it. This approach will ensure a portfolio achieves the optimal mix of risk management while delivering healthy returns.

Innova has more than two decades of experience using ASX and overseas-listed ETFs, as well as a select group of active managers, to actively construct portfolios that deliver targeted returns while managing volatility and the risk of drawdowns in difficult markets.

[1] The first local ETF launched was State Street’s SPDR® S&P®/ASX 200 Fund in August 2001. STW: SPDR S&P ASX 200 Fund | State Street ETFs. (2001, August 24). Retrieved from https://www.ssga.com/au/en_gb/intermediary/etfs/spdr-spasx-200-fund-stw.

[2] Israelstam, I. (2024). Betashares Australian ETF Review: Half Year & June 2024. Betashares. Retrieved from https://www.betashares.com.au/insights/etf-review-june-2024

[3] PricewaterhouseCoopers. (2024, September 26). ETFs 2026: The next big leap. Retrieved from https://www.pwc.com/gx/en/industries/financial-services/publications/etf-2026-the-next-big-leap.html and Assets of global ETFs 2023 | Statista. (2024, September 29). Retrieved from https://www.statista.com/statistics/224579/worldwide-etf-assets-under-management-since-1997.

[4] Factors are the causal rivers of risk in an investment. Many of them offer a positive premium, but many do not, so you need to do your homework. In fact, many apparently different and uncorrelated ETFs are in fact just different ways to get the same factor

[5] Innova. (2024). Active management outperformance may be driven by factor performance – Innova Asset Management. Innova Asset Management. Retrieved from https://innovaam.com.au/factor-investing/hello-world-2

[6] Innova. (2024). Active management outperformance may be driven by factor performance – Innova Asset Management. Innova Asset Management. Retrieved from https://innovaam.com.au/factor-investing/hello-world-2