Where to for future returns: follow the surging index or take a closer look at valuations?

Index investing is a low-cost way to manage risk by investing across a broad market. But dig a little deeper and the surge in recent returns has been driven by something else.

It’s the share prices of a handful of mega-cap high-profile stocks that have soared into the stratosphere, dragging the entire market higher.

What does it mean when stocks such as Nvidia, Alphabet, Meta Platforms, Microsoft, Apple, and Amazon.com are driving returns on the back of the artificial intelligence (AI) thematic?

Tech boom reshapes the index

The broad basket of assets held by most indices tends to defray risk, but there are times when they can inadvertently mask risk. When just a handful of stocks are driving gains, concentration risk and valuation risk come to the fore.

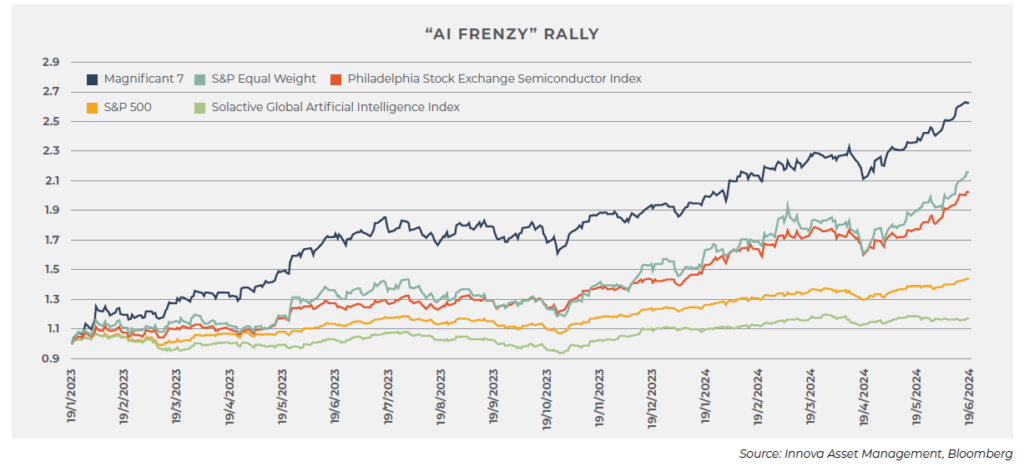

Expensive stocks (such as the “Magnificent 7” led by Nvidia) have become even more expensive while the rest of the market has stood still. For example, the graph below shows a glaring difference between the performance of those seven stocks and the S&P 500 Equal Weight Index.

Investors in a broad-based index such as the S&P 500 face heightened concentration risk – their portfolios are less diverse and returns are highly correlated to a handful of large tech stocks.

Those current high prices also introduce valuation risk. Valuation is such an important concept that it forms one of Innova’s core investment philosophy principles: price drives long-term returns.

It was Robert Shiller who proved it was possible to forecast the broad course of prices over the next five, ten and twenty years based on current valuation metrics.

A high cyclically adjusted P/E (CAPE) ratio signals high prices and lower future returns. Meanwhile, a low CAPE signals a cheaper market and potentially higher future returns.

It means even good companies are less likely to make good investments over the long-term if you overpay for them. Shiller’s work was recognised with a Nobel Prize award in 2013.[1]

Finding value and managing risk

While Nvidia is a good company, the price an investor pays to acquire its shares still plays the dominant role in future returns – and investors are currently paying about 80 times earnings.

The very real risks of investing are not reflected in its price. The AI trend has the potential to transform society, boosting productivity across all companies and boosting earnings. But those benefits are far from guaranteed.

The current high valuations of these companies assumes that they are blue-chip companies with defensive and predictable earnings when they are in fact more susceptible to earnings volatility and uncertainty. Their historical earnings show they are more volatile than cyclicals, but their current pricing incorporates none of this risk.

While a high valuation doesn’t automatically mean a market correction is on the way (which could be triggered by a range of events, such as a geopolitical incident or an earnings miss), it is a possibility. But the most likely outcome for investors is simply sub-par returns over the next five to ten years.

However, there are options and areas of value in equities and in other asset classes that offer a higher expected return, at similar or lower levels of risk. It requires building stronger portfolios that are genuinely diversified. It takes conviction to not follow the herd into high-priced stocks such as Nvidia and others and instead buy low with the expectation of selling high.

One current area of value is the S&P 500 Equal Weight Index given earnings growth outside of the Magnificent 7 hasn’t been reflected across most company share prices. There is also value in the FTSE 100 Index, emerging markets (particularly countries such as Brazil or South Korea), US small caps (the Russell 2000 Index), quality small caps, and sectors such as global health care, which are genuinely defensive.

Outside of equities, global REITS and infrastructure are currently trading at discounts compared to their unlisted counterparts. Domestic floating rate bonds can yield 5-6 per cent at current rates. A strong and genuinely diversified portfolio can limit the impact of large drawdown events, smooth excessive volatility, and still deliver appropriate risk-adjusted returns that meet an investor’s return target.

[1] The work of Lars Peter Hansen and Eugene F. Fama also shared the 2013 Nobel prize. Fama’s work showed that stock prices are extremely difficult to predict in the short term. This efficient markets view underpins the rationale of index funds.