For both individual investors and financial advisors running a broader business, there is often some barrier to fully realising the potential of a robust portfolio process. This might be a lack of time, a lack of resourcing, an unclear or untested process or simply insufficient infrastructure to support the depth of research and decision-making required to risk-manage client capital.

Under this scenario, focusing on investments may compromise the health and success of your broader business – and vice versa, devoting too little time to investments can jeopardise client outcomes.

But what’s the alternative?

Most readers of this article, particularly those who are clients of Innova, would recognise the managed account model: an SMA structure constructed from multi-asset investments, offering transparency and tax-efficiency to end-clients.

But the foundations of the SMA structure, and outsourced investment functions to businesses, was in the institutional landscape. Let’s explore one of the primary services currently being offered to institutional investors to solve the problem of being required to run an investment solution within a much broader business.

The Outsourced CIO Model

The OCIO model has been gaining momentum in the institutional world as a means of delegating investment management and functionality to a third party. This might be a firm or a single consultant, who has the expertise and infrastructure in place to focus on one thing: managing your capital.

Institutional clients are increasingly finding value in this offering since it offers:

- Robust portfolio construction processes beyond their expertise

- Fiduciary and compliance frameworks

- Ease of execution

- Decreased volatility and enhanced risk-adjusted returns

- Cost effectiveness

For the client, the OCIO offering means that they can focus on their wider business – often which is not exclusively focused on managing investments – in a scalable manner which requires no additional staff, regulatory controls, and in fact improves governance and investment outcomes.

Why are we discussing institutional clients in this article?

We believe that with a robust, risk-focussed investment approach, the right managed account solution can offer financial advisors an institutional solution catered to the retail market.

Those same benefits available to institutional clients are as readily accessible for financial advisors and their clients, as are the efficiencies to their business. Let’s unpack two key benefits outsourcing your investment functionality can bring to your advice practice, outside of a potentially superior return figure.

Governance and Compliance

The regulatory landscape facing financial advisers is increasingly burdensome and complex, not only placing greater risk on any business functions which the advisor might not be an expert in, but also places a greater time obligation on managing these compliance protocols.

With the appointment of an external investment advisor/portfolio manager, there are a host of governance benefits which are auditable and verifiable at any time to both build trust with clients and steer your practice on the right side of the regulatory line:

- All reputable consultants will come with an experienced Investment Committee, bringing a scale and team which is not accessible to all but the largest wealth practices

- The decision-making process is well-documented, auditable and has robust rationale behind each step which can be conveyed to a client

- Compliance and governance protocols, infrastructure and documentation, specific to running investments, is already in place

- Your own practice, as well as your clients, can gain comfort in the experience of an external team and a verifiable track record which may take many years (and many market cycles of learning from mistakes) to establish yourself

Relationships and Time Saving

It goes without saying that financial advice is built on trust and a relationship with the client – the service offered to clients is at the nexus of multiple disciplines (tax planning, legal structures, investments and more), and so advisors necessarily need to prioritise their time towards what they can best add value to their client in.

Particularly in regimes where markets are uncertain or volatile, you need to have the time to not only monitor markets during open hours, but also research past movements, consider future return and risk profiles, assess portfolio risk and more.

The time benefit afforded to a business by outsourcing an investment committee frees up advisor’s valuable time to focus on developing new client relationships, developing best practices within their firm and adding scale to their business which is better enabled by having an external team handling all aspects of their investment offering.

Whilst the value of time is often harder to quantify than “an external investment team can add x% of additional return over 3-5 years”, the benefit to a business from having more time to focus on growth and delivering an exceptional client experience should not be understated.

If You Can’t Beat ‘Em, Outsource ‘Em

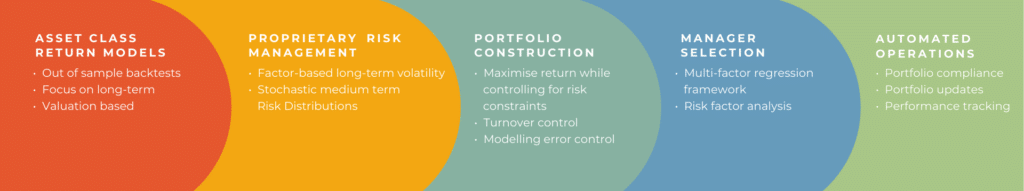

At Innova, we reference our robust, systematically-driven investment process often in our communications: we take great pride in having refined it over many market cycles.

But a better way to frame that might be “we take great pride in delivering you with a robust process” – as an outsourced manager, we are enabling your practice to access this process.

Multi-asset portfolios come as a total portfolio solution, including considerations of client risk and behaviour, regulatory and compliance requirements and of course the risk-adjusted return profile of the investments. In this capacity, we believe that a superior SMA offering should offer the financial advice market an institutional-grade offering, whilst being conscious of the unique landscape of retail advice.