Over the past week, news coverage has drawn increasingly emotional comparisons between the recent U.S.–China tariff escalation and the Great Depression of the 1930s. Major outlets—including The Wall Street Journal, Reuters, ABC Australia, and Bloomberg—have referenced the Smoot-Hawley Tariff Act (1930) as a contributor to that historic downturn, and have suggested we could be headed towards something similar.

While headlines like these get attention, they often oversimplify both the history and what’s happening

today. Yes, the Smoot-Hawley Tariff Act made the Great Depression worse—but it wasn’t the only cause.

Key Takeaways for Investors

The Great Depression wasn’t just about tariffs. It was a complex collapse caused by a mix of poor decisions, weak institutions, and global links.

Some superficial parallels exist today but key differences are more relevant.

We don’t know if the current trade war will trigger a recession. But Innova was prepared before, and we still are now.

The Great Depression: A Multifactor Crisis

The Great Depression began in the U.S. in 1929 and spread across the globe during the 1930s. It wasn’t

caused by one event—it was a combination of policy mistakes and underlying vulnerabilities. Here are some of the main contributors:

The 1929 Stock Market Crash: A bubble burst in October 1929, wiping out wealth and shaking investor

confidence. But it wasn’t the sole cause—it was the

spark, not the fire.

High Interest Rates: After the crash, the U.S. central bank (the Federal Reserve) raised interest rates in 1931 to protect the U.S. dollar. This tightened money supply, worsened deflation, and made debts harder

to repay—deepening the downturn. Milton Friedman and Anna Schwartz famously highlighted this as a key policy failure.

The Smoot-Hawley Tariff Act (1930): This U.S. law raised tariffs 1.on over 20,000 imports to record levels.

In retaliation, over 25 countries imposed their own tariffs, leading to a collapse in global trade. World

trade volumes declined by over 60% between 1929 and 1933, severely hurting export-dependent economies.

Bank Failures and Panic: Nearly 10,000 U.S. banks collapsed between 1930 and 1933. There was no

government guarantee on deposits, so people rushed to pull money out, making things worse. Credit

collapsed, investment froze, and unemployment surged.

Weak Government Response: The U.S. government, led by President Hoover, avoided large-scale support. They stuck to a philosophy of small government and balanced budgets, which limited their ability to cushion the blow. As a result, public investment and safety nets were minimal.

Existing Weaknesses: Before the crisis, the economy was already unbalanced. Farming was struggling,

rural debt was high, and income inequality was severe —leaving the system vulnerable.

The Gold Standard: Many countries were tied to the gold standard, which limited how much they could

adjust monetary policy. This helped spread the crisis internationally

In short: the Great Depression wasn’t simply triggered by trade barriers. It was the result of deeper and broader failures across the financial and policy system.

2025: What’s the Same—And What’s Not

Yes, the U.S. has introduced large-scale tariffs and China has retaliated. Markets have reacted sharply. But it’s crucial to focus on the differences, not just the surfacelevel similarities.

Stronger Central Banks: Today’s central banks (like the U.S. Federal Reserve and the RBA) have more tools at their disposal. They can lower rates, inject money into the system, and support financial markets quickly—unlike in 1930. They have acted swiftly in past crises (e.g., COVID-19), and there’s no gold standard tying their hands.

More Flexible Government Spending: As we saw during COVID and the Global Financial Crisis (GFC), modern governments are more willing to step in with large stimulus packages. They’re not restricted by outdated beliefs about keeping budgets balanced during economic stress.

Better-Regulated Banks: Banking systems today are more robust, with stronger rules, better capital reserves, and protections like deposit insurance—all of which reduce the risk of widespread bank runs.

A Stronger Starting Point: Before this trade tension emerged, both the U.S. and Australian economies were in a good place—low unemployment, steady inflation, and strong consumer spending. That’s very different from the fragile conditions leading into the 1930s.

Trade Today vs. Trade in the 1930s

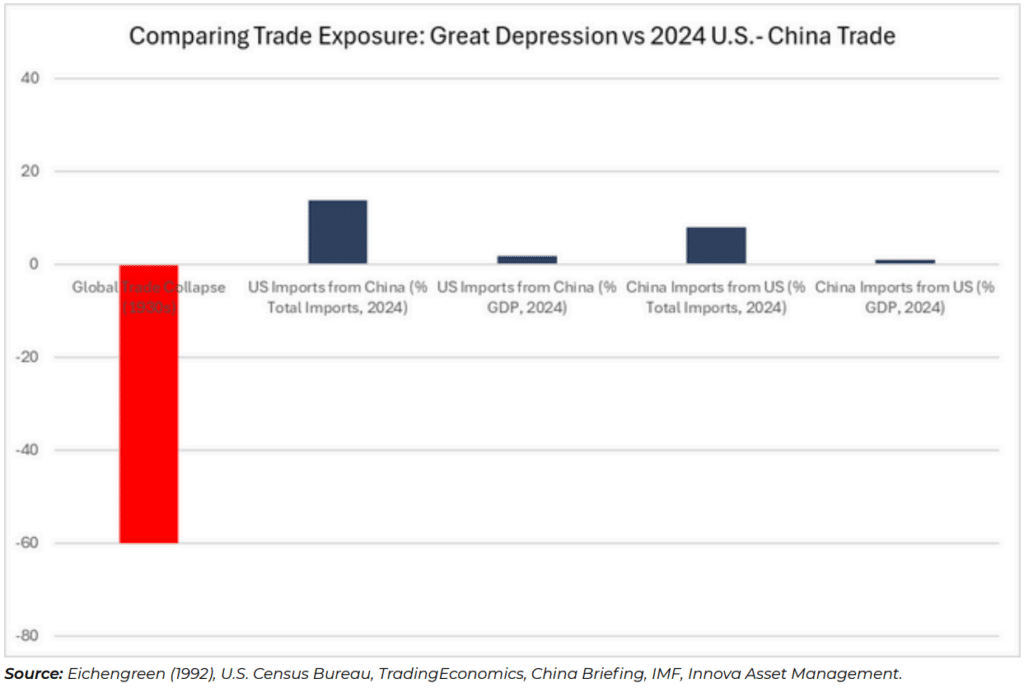

It helps to compare the scale. While U.S.–China trade is significant, it’s much smaller relative to total global trade and GDP than the volumes lost in the 1930s. Back then, world trade dropped by over 60%—we’re nowhere near that level now.

The Danger of Oversimplified Headlines

Comparing today’s market to the 1930s may make for dramatic headlines, but it can mislead investors.

Here’s why:

- It hides how much stronger and more flexible our financial systems are today.

- It can create unnecessary fear and prompt poor decisions.

- It distracts from what really matters: understanding the actual risks and staying focused on fundamentals.

To be clear: a slowdown or mild recession is possible if the trade war drags on. But assuming we’re on the edge of another Great Depression is not supported by the evidence.

As long-term investors, we must recognise risks without reacting emotionally. History has important lessons— but we need to interpret it with context, perspective, and a clear view of what’s changed.

Quarterly market update | Q1 2026