All charts’ sources are Bloomberg, Innova Asset Management

Quick review of 2024

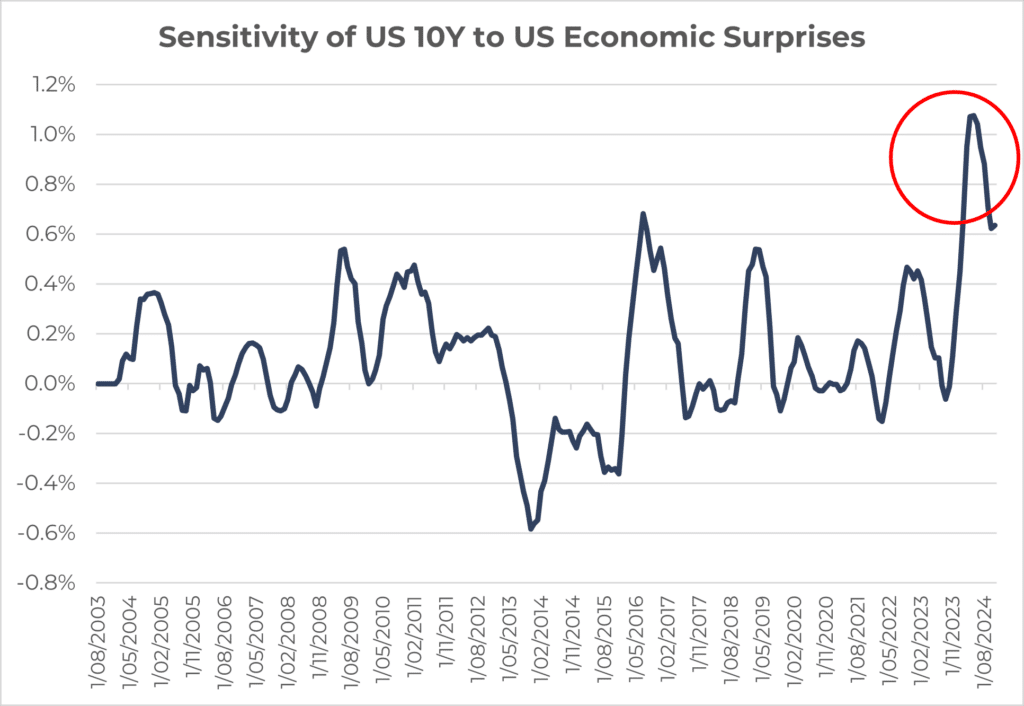

Looking back at 2024, it’s fair to say that it was an unorthodox year for markets, with many individuals being surprised by US exceptionalism, the dominance of AI investment and Trump marching back into presidency, securing a “Red Sweep”. Fixed-income and currency markets were particularly sensitive to macroeconomic announcement surprises, even on the margin, which caused heightened realised bond market volatility, and actually made equities quite an attractive risk-adjusted investment.

However, being selective in fixed-income via credit markets with less interest-rate sensitivity again proved to be a prudent strategy, where our overweight to domestic floating rate notes shined.

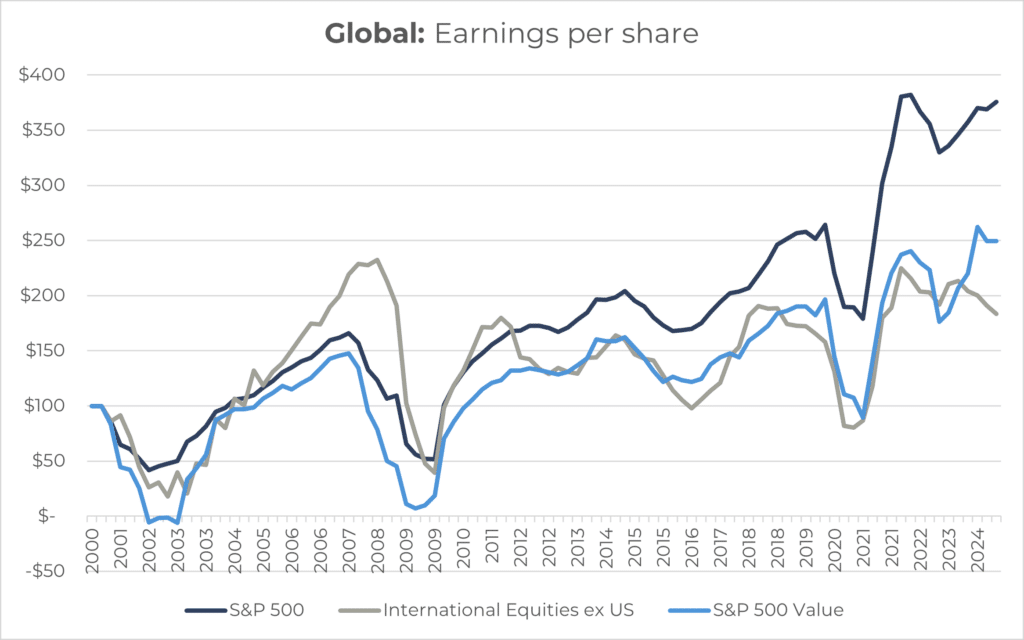

The US mega caps continued to be the main drivers of earnings globally in 2024, though some convergence has begun leading into 2025, with a broadening in price action into cyclicals and small caps. Below illustrates that the Magnificent 7 are growing earnings but at a slowing rate relative to earlier in 2024. Whether they can turn their AI CAPEX spend into profitability will determine the fate of higher bids for the AI darlings.

This development aligned with our early 2024 base case of a soft-landing scenario, where rate cuts would bolster unfavoured, rate-sensitive sectors like small-caps and REITs. Additionally, easing monetary policy in a robust economy with resilient labour markets would alleviate growth uncertainty and support undervalued cyclical assets globally. This global recovery narrative is significantly enhanced by renewed optimism surrounding Donald Trump’s potential to reinvigorate “animal spirits” in the markets. His anticipated policies, particularly tax cuts and deregulation, are expected to bolster M&A activity and have already pushed up small caps, the US dollar, industrials, bitcoin, and regional banks.

His vocal threats of imposing tariffs on global trade partners, particularly China, Mexico, and Canada, appear more intimidating than substantive. The fiscal uncertainty around his appointment has steepened the yield curve and has some investors concerned around inflation. It’s important to note however, that the US since COVID have had high labour productivity despite massive immigration and have demonstrated an ability to allocate their resources to productive parts of their economy.

Looking to 2025

Our view

Below is a visual that may help illustrate our base case and the potential tail risks we see on either side:

Overall, whilst our base case sits in the soft-landing camp, we believe the risks are slightly tilted towards stickier inflation and hence higher rates for longer, rather than an outright deflationary shock, a typical “growth recession”. Easing monetary policy into strong growth, resilient labour markets, rising real wages for consumers who are spending well, and supportive fiscal spending generally means positive outcomes for risk assets.

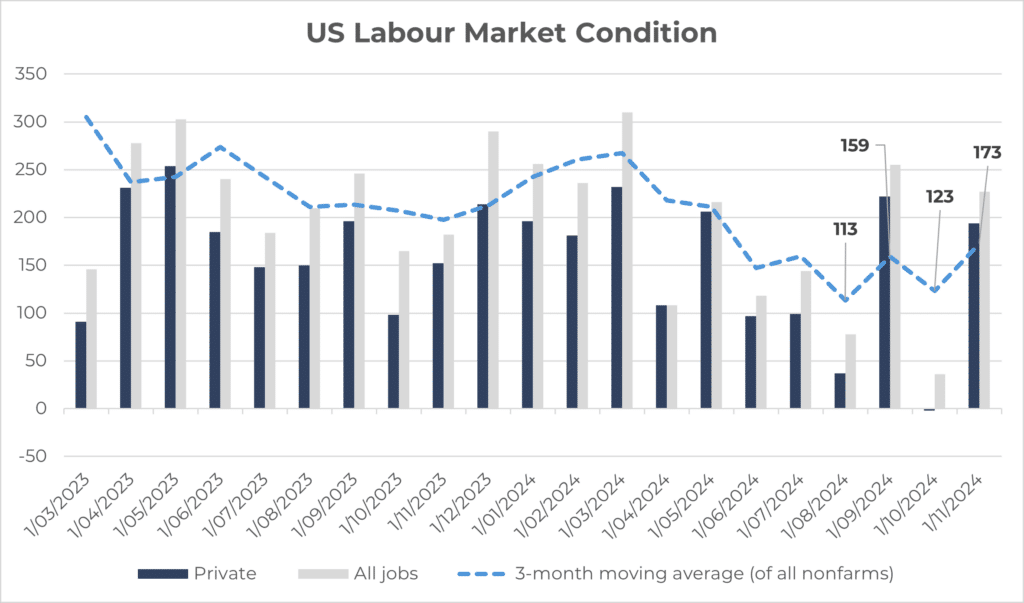

Labour market conditions have also not shown any meaningful signs of deterioration besides some idiosyncratic blips from weather events and strikes.

Within fixed-income, whilst we do lean towards core-inflation perhaps struggling to trod too much lower, the starting yields are quite attractive relative to the past 20 years, and therefore the income can easily offset any smaller price movements. Below is a rough example, assuming 7-years of duration where the 10Y bond goes from 4.5% to 5%:

Bond Price Change = -Duration X Change in Yield = -7 YRS X 0.5% = -3.5%

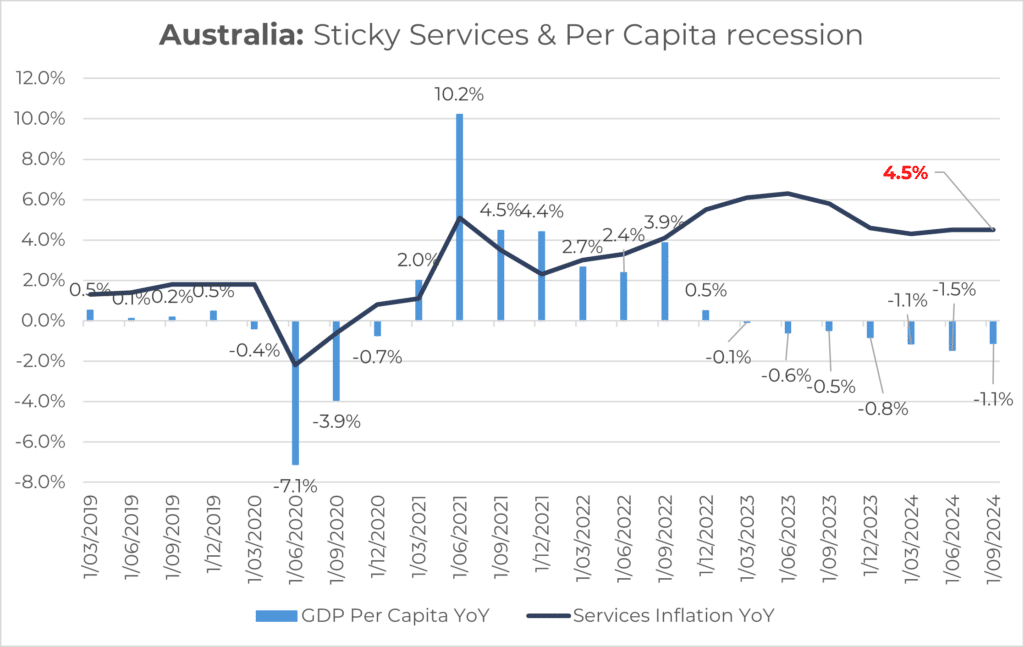

With that said, we prefer the shorter to medium dated end of the curve, around that 3–4-year duration mark. Geographically, Australia is quite a bit behind the rest of the developed economies given it hasn’t cut rates at all. We do believe that in early 2025 inflation will begin to slowly cool and hence we may see a couple of rate cuts domestically. Australia also does not have the same fiscal concerns as the US and some areas in Europe such as France and the UK, hence less idiosyncratic risk for the long end of the curve.

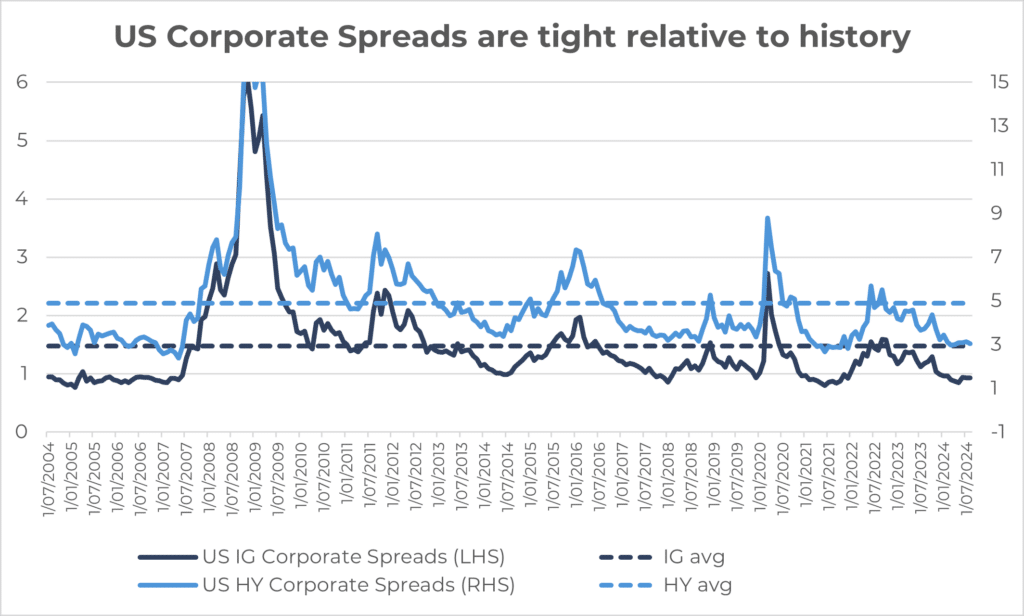

Spreads in the US continue to be tight, though high yield fundamentals have structurally improved due to junk’s flight to private equity. Defaults are low and spreads tightening are following valuations expanding on the equity side.

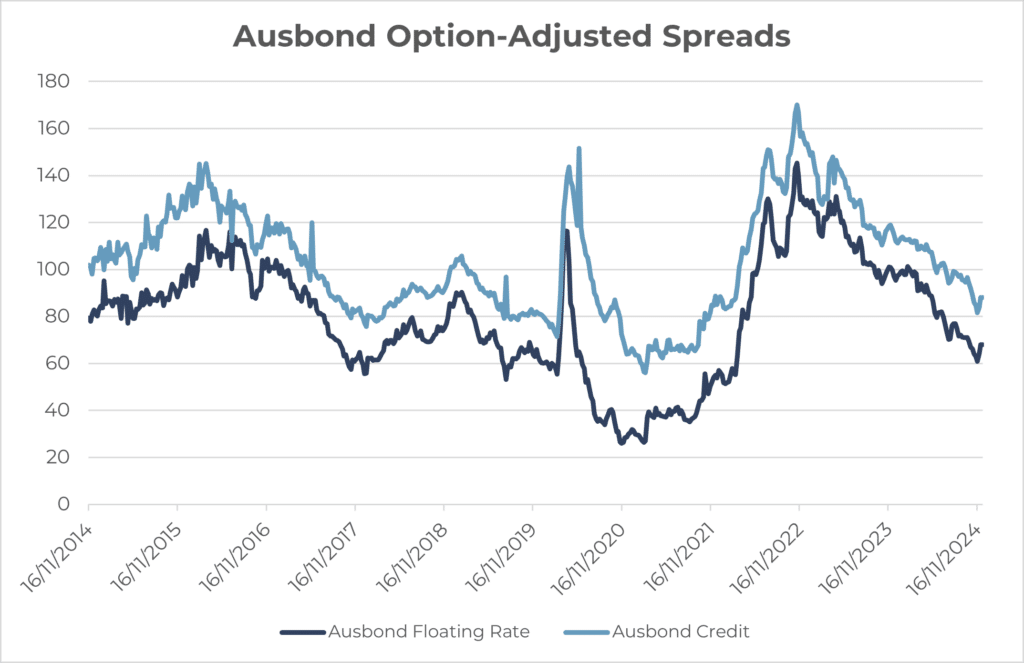

Domestically, Australian spreads have certainly tightened meaningfully since the beginning of the year:

Despite this, given the structural improvement in Tier-2 credit quality, and the historically tight regulation held by the banks within Australia, we still prefer domestic credit to US.

Risk assets align with consensus

Developed Markets

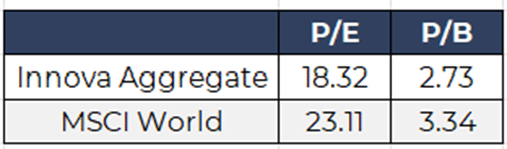

It is currently very much consensus that risk assets should enjoy another strong year in 2025, with the rally broadening out from the AI winners and mega caps in the US, towards more cyclical areas. We’ve held this view since earlier in 2024, and the further developments in macroeconomic conditions, political outcomes and earnings trends leads us to continue to believe this narrative. We expect the “US exceptionalism” to continue and Trump’s deregulation to support domestic industrials, regional banking and US small caps. The S&P 500 Equal Weighted index has significant mid-cap cyclical exposure, with its highest weightings to industrials (16.5%), financials (15.5%) and IT (13.65%), though without the heavy concentration and valuation risk of the S&P 500. This index alongside a quality and pricing-power filtered global small caps strategy are some of our higher conviction active calls, which should benefit from a cyclical recovery and the continuation of US exceptionalism via supportive fiscal and monetary policies.

Outside of the US there isn’t a whole lot of economic growth in the developed world, with Europe on its knees and Japan recovering from the volatility shock of August. Japan’s fundamentals nonetheless do look enticing, and hence being selective within the country can lead to attractive opportunities. We are overweight the UK for its defensive attributes as well as shorter duration equities which in 2022 was a huge beneficiary due to the inflation shock. Overall, our global allocations are tilted towards small caps, value and relatively flat on quality and momentum.

We also prefer more appropriately valued global factors such as enhanced value and quality small caps, over expensive areas such as quality and growth. This is both true on an absolute basis, and a relative basis. Historically, valuation gaps between factors have led to subsequent outperformance for the next 5-10year period for the cheaper factor.

In terms of earnings, there is certainly double-digits earnings growth in certain areas such as Korean equities, small caps and the S&P 500 equal weight, that did not exist in 2024:

China and Emerging Markets

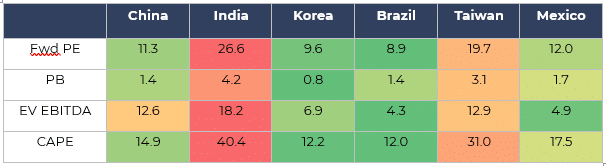

It’s clear that the Chinese government have attempted to put a floor under some of the Chinese assets who were building negative momentum. However, we have not seen any meaningful fiscal support that would turn the tide completely. Therefore, we remain cautious on Chinese equities until we can see meaningful evidence of a turn around in their real economic concerns such as deflation, property crisis and deleveraging.

Other emerging markets may struggle in 2025 if the USD continues its strength, which depends a lot on which policies are actually enacted by the Trump administration. Areas such as India and Taiwan are looking quite expensive, though South Korea is an overweight in the portfolios which should benefit from the global recovery story and valuation mean reversion.

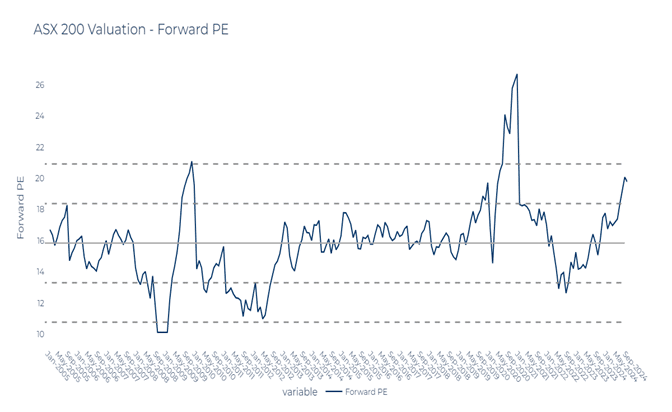

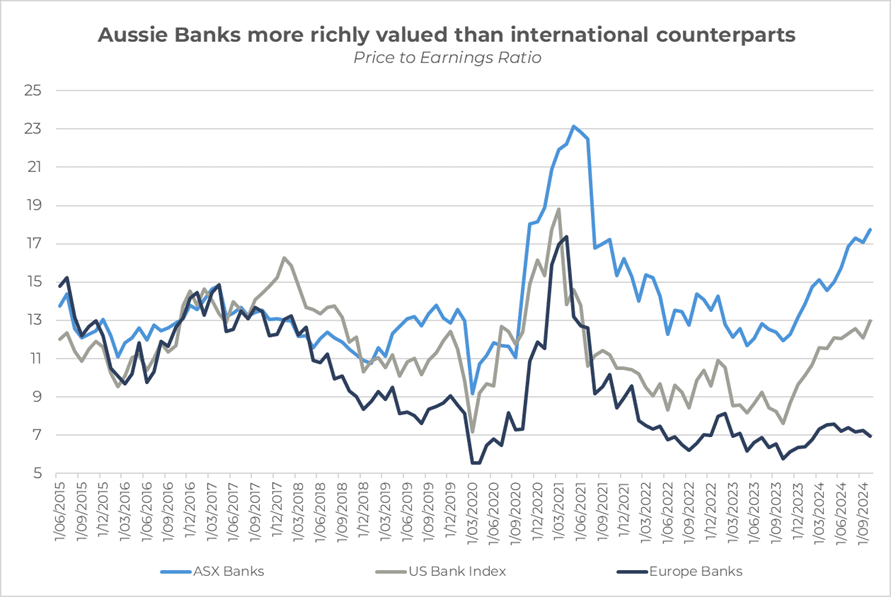

Australia

2024 was great for Australian banks and terrible for Australian cyclicals such as materials and miners. Given the tight spot the RBA are in, as well as the heavily leveraged households who are struggling to service their mortgages, we remain cautious on discretionary-related sectors in Australia. The ASX200 remains at all time high valuations driven by the big 4 banks, which seems to be defying expectations and gravity.

We remain defensive in domestic equities in areas where valuations are more reasonable.

We believe the asymmetric effect of higher rates will continue into 2025, where savers continue to grow wealthier, whereas borrowers suffer. The country is relying solely on higher-than-average immigration and government spending for its growth, an unsustainable combination given the structurally stickier core inflation running through healthcare and construction.

The fork in the road – the bond market

One area which has a lot more contention is the bond market. One side believe the fiscal uncertainty and recessionary-type deficits in the US will mean that the bond market will struggle to rally whatsoever and may see the 10Y float beyond 5%. On the other hand, the disinflationary trend has been quite meaningful over 2024, and the Federal Reserve have begun their cutting cycle amid some shakiness in the labour markets. Trump’s re-election saw a steepening of the yield curve via a “bear steepener” (where the long-end of the curve causes a dis-inversion in the 2s10s), perhaps signalling a normalisation of financial conditions, though with a higher neutral rate or “baseline” level of growth and inflation. This move brought “term premium”, which means investors now demand to be paid for 10-year bonds relative to 2-year bond yield due to future uncertainty. This move was driven by higher levels of fiscal and policy uncertainty, encompassing a range of potential policy changes, including tariffs, tax cuts, deportation, deregulation, and an overarching theme of deglobalisation.

Concentration

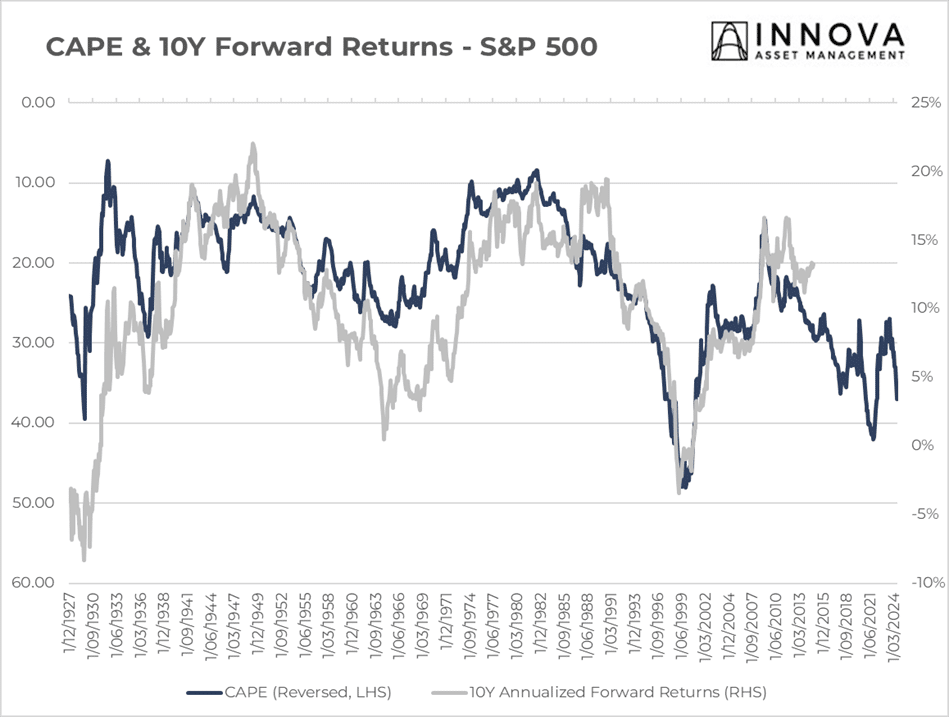

We’re still slightly concerned about the concentrated S&P 500, which has ultimately become a bet on mega-cap, momentum, growth, AI and technology. Whilst we think some commentators are perhaps overcooking the concern regarding concentration, the valuation level is certainly a problem. We know that high valuation leads to lower subsequent returns as evidenced below:

However, one must be careful as US exceptionalism is real, and a lot of the profitability and earnings growth has been carried by the United States. This is a structural change in global markets, which should be considered when betting on any type of mean reversion.

Concluding Remarks

In summary, while the base case for 2025 leans towards a positive economic narrative fuelled by favourable fiscal policies and resilient growth, risks persist. We encourage being selective within equities, focusing on undervalued cyclical assets, smaller companies with pricing power, and maintaining vigilance regarding inflationary pressures and geopolitical uncertainties. A lot is dependent on the timeliness of Trump’s policies and whether the tariffs were merely threats rather than reality. This will also play a big role in shifting the yield curve, as well as the US dollar, which was very strong in 2024.

Quarterly market update | Q2 2025