“CAPE at 38” ……… “Mean Reversion” ………. “The S&P 500 is surely going to revert back to its long-term average of 19, which would imply a 50% drawdown in US equities in the next 10 years!!!” …..

These phrases and statements have swamped the internet and investment blogs, fuelled by the S&P 500’s exceptional performance with two consecutive years of 20%+ returns. Such a streak is indeed remarkable for a broad equity index, making it unsurprising that sceptics emerge to caution investors about an impending market crash, labelling the market as “expensive.” This concept of “expensiveness” within valuation ratios warrants deeper exploration and should not be viewed as a standalone indicator for short-term equity timing decisions.

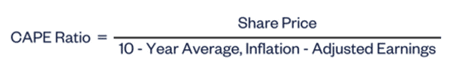

Instead of presenting a typical “starting CAPE & subsequent 10-year return” chart, which has its own statistical flaws —let’s look at data without any overlaps. While I’ll assume readers have a basic understanding of the CAPE ratio, a quick refresher:

- CAPE: Calculated by dividing the price of an equity index by its average inflation-adjusted earnings over the past 10 years, designed to smooth out the effects of macroeconomic cyclicality.

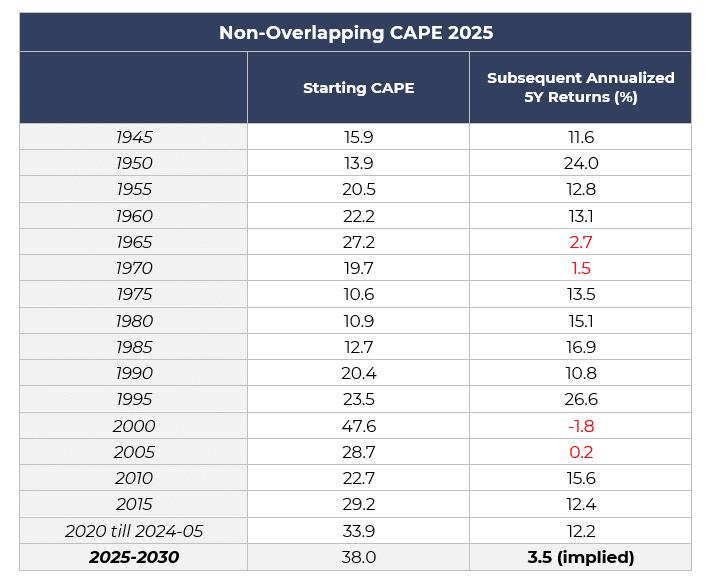

Non-Overlapping Valuation & Subsequent Returns

The table below features non-overlapping data, for which the sample size is quite small, but demonstrates intriguing results. It would be amazing if we had data for 1000 years, but we’re working with close to 100, which isn’t horrible. What we can see is a clear pattern, when the starting CAPE is high, the future 5-year return is low.

Source: Shiller website, Innova Asset Management, Bloomberg

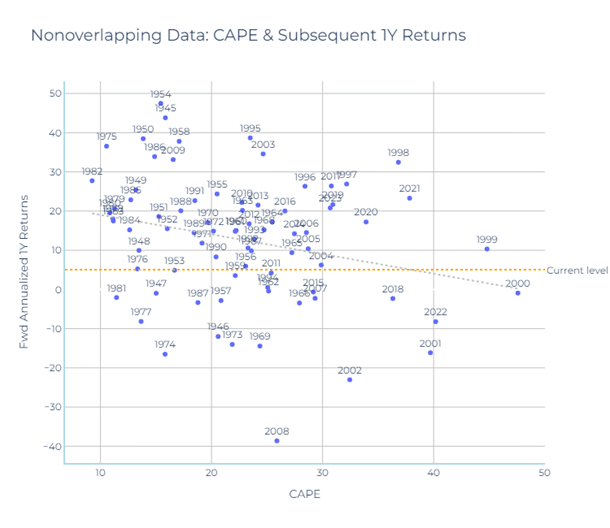

This paints a clearer picture than a rolling scatter plot with overlaps, but below we’ll show the scatter plot of the above table anyway to show the fit. The years are the starting year for the CAPE ratios and their subsequent 5-year returns. The current level of 38 implies a 3.5% annualized return over the next 5 years.

Source: Shiller website, Innova Asset Management, Bloomberg

High starting CAPE ratios generally tend to lead to lower future returns, despite a few instances when “expensive” has gotten more “expensive”. We can see in 2015 at a CAPE of 29.2, the next 5 years realized an annualized 12.4%, which is strong, however, this is quite rare.

So, if the next 5-year annualized returns are implied to be around 3.5% according to this model, should one go all bonds? Well, it’s not quite that simple, as the macroeconomic backdrop and expectations for fundamentals for US equities is actually quite good:

- Monetary easing cycle

- Fiscal policy looking beneficial for consumption and small-to-mid size business growth

- Strong GDP and stable employment

- Double-digit earnings forecast for 2025 and 2026.

On top of this, when we look at the nonoverlapping data for 1Y forward returns, the fit becomes much less compelling, explaining only 7% of the future 1Y returns, compared to 33% of 5Y future and 61.6% of 10Y future returns (with only 7 observations however):

Source: Shiller website, Innova Asset Management, Bloomberg

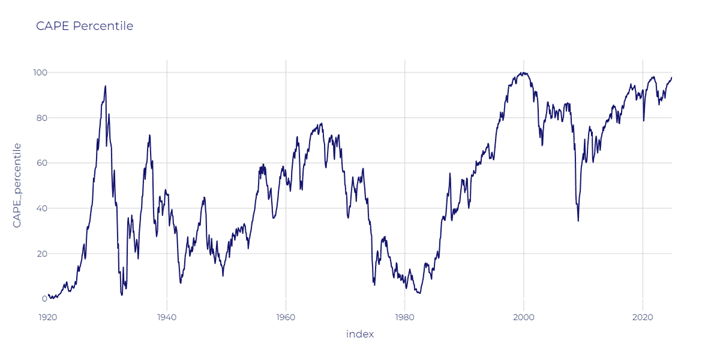

We don’t suggest using valuation as a timing tool for the next 1 year, but we remain cautious of equity markets with valuation ratios that are sitting at their 98th percentiles.

Source: Shiller website, Innova Asset Management, Bloomberg

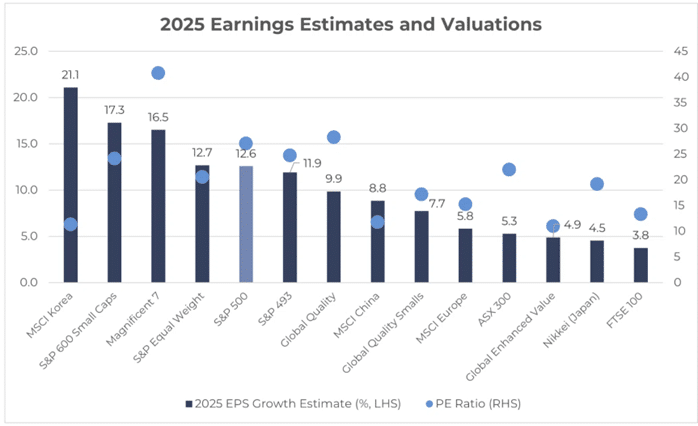

This is especially true when there are equity sectors that trade at huge discounts to the expensive market (S&P 500) yet share similar future forecasted earnings growth and have potentially stronger macro tailwinds (cyclical benefitting from strong GDP and cyclical recovery)!

Source: Innova Asset Management, Bloomberg

Hopefully showing data without overlapping dates has provided some clarity around what starting CAPE may actually imply for future returns. It’s clear that higher starting CAPE poses a risk for future returns, though we acknowledge there are several criticisms such as:

- Changes in sector composition

- Upward structural trend in valuation level

- “This time is different” …. And so on.

We will address those in the next note, with a slightly more technical tone.

Quarterly market update | Q2 2025