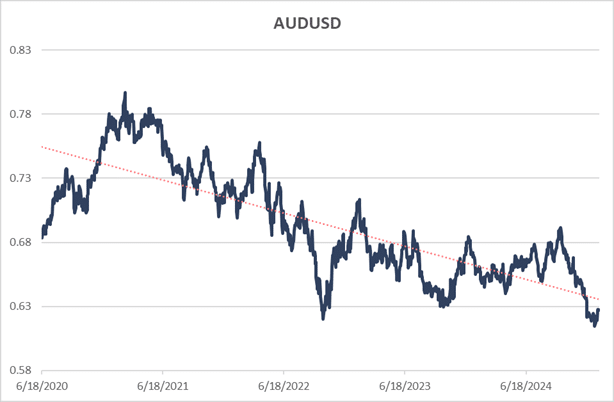

It’s been a real rough ride for the Australian Dollar/United States Dollar currency exchange over the past year. Unfortunately, on any upcoming holiday to the US, you’ll get around 9% less.

Source: Innova Asset Management, Bloomberg

With that said, is this trend going to continue, should you dump your Aussie dollars and hold all your cash in US Dollars?

Whilst it may be unnerving to see the value of your cash depreciate relative to other currencies, it’s important to try and understand why this fall happened, and given this decomposition, whether it’s likely to continue or not.

The fall in the pair has largely been driven by US strength, not Australian weakness. Let’s try and do a simple decomposition of past 1 year returns for the Australian dollar.

Here is a table of the Australian dollar and how it went in 2024 against other major currencies:

| AUDUSD | AUDJPY | AUDCAD | AUDCHF | AUDNZD | AUDEUR | AUDKRW | AUDGBP | |

| 2024 Return | -9.2% | 1.3% | -1.5% | -2.2% | 2.6% | -3.2% | 4.0% | -7.6% |

Source: Innova Asset Management, Bloomberg

Besides the GBP pair, the USD pair stands out as an outlier. If we take out the Aussie dollar’s loss against an equal weight of the other major pairs, we can isolate how much approximately was caused by US strength.

Caused by US Strength = Loss of AUDUSD – Loss against average of major pairs

Caused by US Strength = 9.2% – 0.9% = 8.3%

This leaves approximately 0.9% that may have been caused by genuine Australian weakness. Of course, this is just a rough estimate, and not entirely accurate, but it illustrates that the Aussie dollar isn’t the sole cause of the weakness against the USD.

Why USD Strength?

The strength in the US economy, threats of tariffs from the Trump administration, a wind-back in expected rate cuts from the Federal Reserve (and hence rising bond yields) are all reasons for this USD strength.

Why AUD weakness?

The rest we can perhaps attribute to weakness in the domestic economy, as well a crumbling Chinese economy, which has caused less demand for our natural resources. Historically the AUDUSD has been meaningfully driven by commodity prices and the demand from China – though given the heavy strength from the USD side of the pair, this cycle is slightly different. Though, in the past year, we’ve seen both sides of the pair “AUD” and “USD” work poorly for Australians as the Chinese real economy has been weak and the US economy has been strong (so AUD down at the same time as USD up). Despite this, the Chinese government has made it pretty clear that they’re attempting to put a floor under the current troubles via monetary measures and light fiscal initiatives.

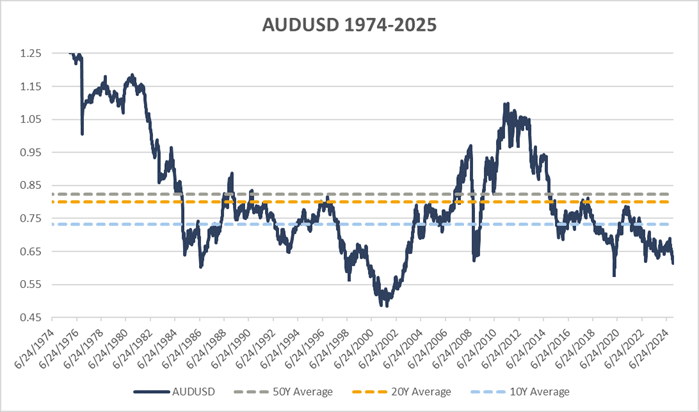

Back to the mean?

In the short term, these factors are expected to continue, especially as uncertainty around Trump’s first quarters brew in the macroeconomic vicinity, however long term we can expect currencies to revert to a longer-term mean.

Source: Innova Asset Management, Bloomberg

Depending on how far you look back, this mean is either 82c, 80c or 73c. Reversion to these means would yield a currency return of 33%, 29% and 18% respectively!

What drives the AUDUSD, and has it changed?

Putting forward a simple mean reversion argument is always easy, but there is a reason assets trade cheaply and hence we want to understand what actually drives the pair between the AUD and the USD. Let’s look at some intuitive variables and test whether they are important in influencing the moves in the AUDUSD.

Variables:

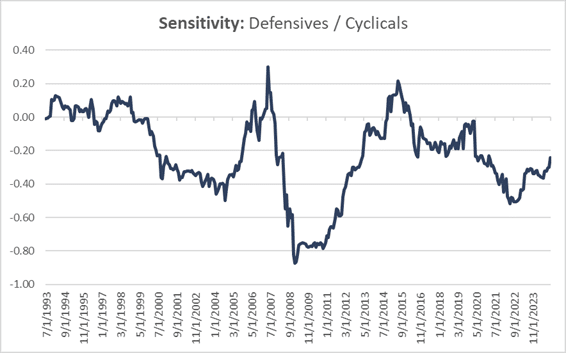

- Risk-off (Defensives minus Cyclicals equity sectors)

- Rate differentials (AU10Y minus US10Y, RBA cash rate versus the Fed Funds rate)

- Commodity prices

We run a full-sample multivariate regression (1990-2025) after confirming that the 3 variables aren’t correlated significantly:

| 1990-2025 | ||||

| Variable | Sensitivity | T-Stat | Significant at 95%? | Significant 99%? |

| Defensives vs cyclicals (risk off) | -0.22 | -5.74 | Yes | Yes |

| Rate differentials (AU10y minus US10y) | 1.03 | 1.94 | No | No |

| Commodity prices | 0.44 | 13.49 | Yes | Yes |

- As expected, the AUDUSD acts as a risk-on currency (meaning it generally goes up when ‘risk’ assets like stocks go up), being negatively related to “defensive long vs cyclical short” equity sector spread

- Others are also intuitive:

- AU10Y higher than US10Y yields means more capital would be attracted to the Aussie dollar (as investors have to convert USD to AUD in order to buy Aussie 10y bonds).

- As a commodity exporter (iron ore, coal), it would make sense for the Aussie dollar to be positively related to changes in commodity prices.

Have they changed over-time?

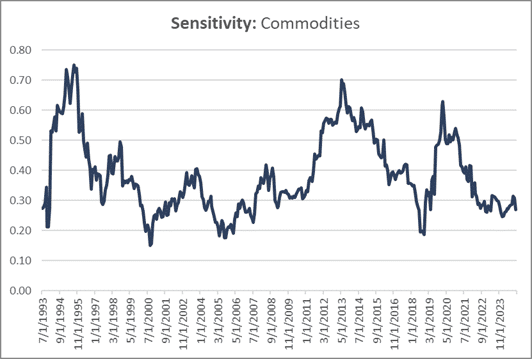

Below we show the 3Y rolling sensitivity in the multivariate framework, to see whether these variables have changed in importance over time.

Source: Innova Asset Management, Bloomberg

Source: Innova Asset Management, Bloomberg

Source: Innova Asset Management, Bloomberg

We observe that most of those factors’ sensitivities have stayed similar, though the sensitivity to commodities has lowered a fair bit since COVID and post-GFC. Since around 2000, rate differentials have been a significant driver of AUDUSD returns too, with higher AU10Y relative to US10Y meaning a higher AUDUSD.

What does this mean for portfolios?

Given the drivers of the Aussie dollar haven’t dramatically changed over the past 10-year, at levels close to 0.6, it may be prudent to dollar cost average back into “hedged” global equity positions due to the long term mean reversion in currencies. ‘Hedging’ involves selling the currency an asset is priced in, e.g. the S&P500 being priced in USD, and buying the currency you want to hedge to – basically buying Aussie and selling USD. Given the AUDUSD is a “risk on” currency, we can look at historical “risk-off” times such as COVID to understand how low the lows are for the AUDUSD:

Source: Innova Asset Management, Bloomberg

At the current exchange rate around $0.62 – $0.63 we’re very close to what we saw in Armageddon-type times, even though equity markets have been rising. So taking a long-term view and not timing could be a fruitful trade, as the potential downside is likely limited but any move towards the long term average would be very profitable. This isn’t to say that in the short term, the macroeconomic and technical headwinds might push the AUD lower, but those with a longer time horizon should look through the noise in the months ahead.