Every market cycle has its own unique drivers but how each generation reacts depends on their distinct goals and values.

Understanding just how they differ will define the future relevance of the investment industry as a $3.5 trillion-dollar generational wealth transfer is underway.[1] While younger individuals differ, there is no doubt they are navigating a radically different world.

They have grown up with less job security while the interconnected nature of the internet has encouraged multiple sources of lower income-generating side hustles (usually without superannuation). High prices are removing property as a source of wealth generation for many as Australia’s housing crisis shows no signs of being resolved soon.

When younger people do invest, they have different expectations which are often tied to their values – and not just ESG-related. When investing in their own education, record numbers of students are enrolling in arts degrees despite a 113 per cent rise in student contributions implemented just a few years ago to encourage greater take-up in other sectors of the economy.

Risk and return

While younger investors may more commonly prioritise lifestyle over money (as opposed to just using money to fund lifestyle), many of the studies show seemingly contradictory results in terms of their attitudes to risk and return.

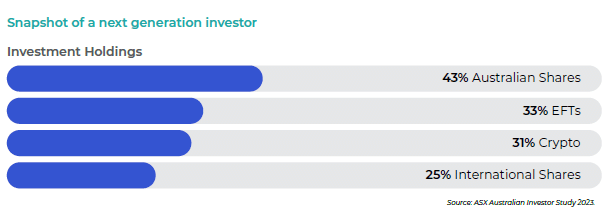

Investors aged 18-24 made up nearly 10 per cent of investors in the ASX’s 2023 Australian Investor Study. They held fewer Australian shares than the broader population (43 per cent versus 58 per cent), but were more likely to hold ETFs, invest internationally, and hold cryptocurrencies.

Snapshot of a next generation investor

Many of these investments are high-growth assets, while cryptocurrencies are highly speculative, risky investments. Yet the survey also found that more young people had a lower tolerance for volatility and wanted to build an income stream compared with retirees.

The lifestyle factor may again be at play: regular income may traditionally be derived from work, but passive investment income can help pay for activities like travel.

Another recent survey by social research firm McCrindle found Generation Z prioritised their dream life (71 per cent) over their dream home (29 per cent). It may also be a factor behind the rise of the FIRE (Financial Independence, Retire Early) movement, driving people to live frugally in the hopes of retiring young.

The reality is most Australians are retiring at their oldest ages since the early-1970s partly thanks to more flexible workplace trends, according to KPMG.

Untangling the inevitable financial and lifestyle trade-offs that young people will have to make as they age is a challenge for advisers and the investment industry. But there are clear trends among younger investors that the industry should take heed of.

More control and transparency

Investment platforms that currently dominate the industry may not be as popular among the next generation of investors. They have grown up with easy access via share trading and cryptocurrency platforms and expect more control and transparency than they get from managed funds and similar vehicles.

They will also expect more engagement given the investment platforms they use gamify the investment experience. This may be a trend that encourages poor investing habits (in riskier asset classes or more trading) but there is no doubting it is engaging.

More demand for ETFs

ETFs blend the control and transparency that young people want with greater diversification.

But the Australian ETF market is still in its infancy compared to the US market, even as demand continues to surge. There were a record 56 new ETF product launches and a record $15 billion in net inflows across the sector in 2023, according to ETF provider BetaShares.

It is inevitable that there will be more specific ETFs launched to meet this demand, allowing even more tailored portfolios to be built. Not all of these investments will be popular among the traditional investment industry. The best performing ETF last year was the high-risk BetaShares Crypto Innovators ETF (although it invests in crypto infrastructure rather than crypto-currencies).

Education

It is incumbent on the industry to improve the way it provides information to younger investors. Younger investors’ most popular education sources are online videos and social media, compared to the broader population who prefer online reading materials such as PDFs, according to the ASX.

If the advice they receive is poor, it will likely disappoint over the long-term (at least without a dose of luck).

Traditional face-to-face advice will always have a place, but younger investors are also more open to digital advice – the only question is who will deliver quality, scalable advice over this medium.

The property question

Australia’s housing crisis has broader implications for society and younger people are set to pay the price. Home ownership is also crucial to set up an affordable retirement lifestyle. While a minority of young people will inherit property (or borrow from parents), the majority will struggle to afford secure housing.

As a pure investment, housing will not generate the same wealth for many of this new generation locked out of the market. They will look elsewhere. What type of investments they turn to, and whether the risk they take on is excessive, remains an open question.

[1] Commission, C. (2021, December 07). Wealth transfers and their economic effects – Commission Research Paper. Retrieved from https://www.pc.gov.au/research/completed/wealth-transfers

Quarterly market update | Q2 2025