Almost half of pre-retirees are invested in MySuper products despite traditionally facing significantly more investment risk than younger Australians, according to APRA data.

It suggests a significant cohort of older Australians remain disengaged and are not receiving crucial financial advice during the critical years before retirement.

But while most younger investors – who are also disproportionately invested in default funds – would be better off investing in higher-growth equity portfolios, the options are more complex for pre-retirees.

They need strong returns to help fund decades in retirement, but are more exposed to sequencing risk, which describes the higher impact that a market downturn can have on their retirement savings.[1]

The typical advice is to lower portfolio risk as retirement approaches, which is something that lifecycle funds do automatically. However, this may not be good advice for many pre-retirees with lower balances.

The complexity of retirement

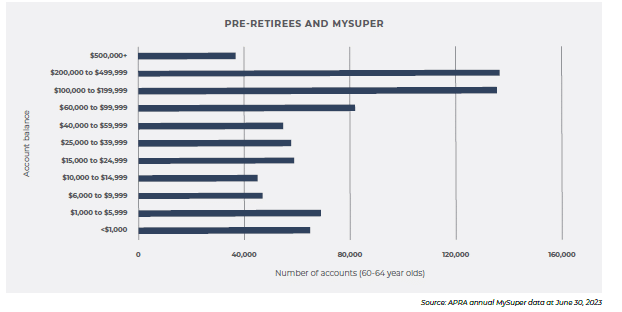

The APRA data shows that 46.4 per cent of the near 1.7 million member accounts held by 60-64 year olds were invested in MySuper funds at June 30, 2023. But a closer breakdown of account balances suggests different portfolios may be needed depending on account balances.

About 60 per cent of pre-retiree MySuper accounts had low balances below $100,000. The remaining pre-retirees invested in MySuper had substantial assets above $100,000 (including 174,000 accounts above $200,000).

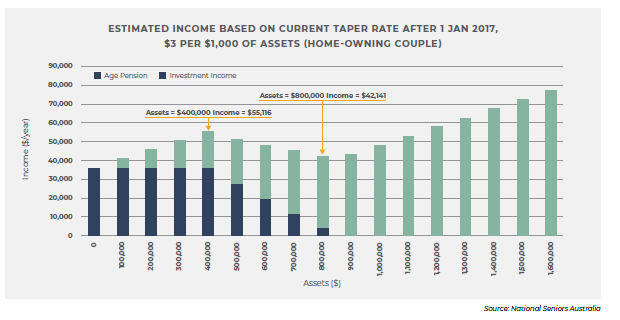

As super savings grow, the value of the government Age Pension is cut by an even greater amount thanks to a quirk in Australia’s retirement system, as shown in the graph below.

Source: National Seniors Australia.

Older investors with lower balances (particularly those caught in the Age Pension ‘taper trap’) may be able to invest more aggressively than default MySuper products knowing that the Age Pension will pick up any shortfall if markets tank.

Pre-retirees with substantial savings above $500,000 are more likely to need to protect those assets from the risk of a market downturn. Australia’ default MySuper funds are among the most aggressive in the world, allocating 60-70 per cent in growth assets such as equities.

These are complex calculations that require financial advice. The appropriate portfolio can be further shaped by the personal lifestyle goals of pre-retirees, as well whether they own their own home.

Regulatory risk is another factor. Some pre-retirees with substantial assets will want to self-insure against inevitable changes to super, as well as Age Pension eligibility (which increased to age 67 from 65 last year).

Better portfolios for retirement

Default MySuper funds were created a decade ago as a simple, cost-effective, balanced product for the vast majority of Australian workers. They are an important backstop but won’t be, by definition, not the most appropriate choice for many investors.

More recently, the regulator has been attempting to move the super industry towards more tailored solutions through the Retirement Income Covenant. Funds are expected to incorporate more personalised member data into their default retirement solutions in something of an ‘advice lite’ approach.

MySuper lifecycle funds were an early structure that aimed to do this by de-risking a portfolio as investors approached retirement. Most of these use the blunt instrument of age and neglect other basic facets such as total account balance and even home ownership. They also fail those investors who would be better served by investing in a growth-oriented portfolio even as they approach retirement.

Savvy investors should instead seek personal advice, which doesn’t have to be all-encompassing. It can be limited to particular areas, such as retirement. This approach can more than pay for the cost of advice, which is often cited as a reason stopping people from working with advisers.

Without a more customised approach, many pre-retirees will remain in MySuper funds. Those with low balances could consider being invested more aggressively, such as

the Innova Aspiration portfolio[2], while those with high balances may consider de-risking their portfolios through an option such as the Innova Lifestyle Preservation Portfolio[3]. Only the power of personal advice can direct investors to the most appropriate portfolio.

[1] A key reason is older investors are often drawing down assets when they have fallen in value, while younger investors are still saving and effectively buying assets when they are cheap.

[2] The Innova Aspiration portfolio targets a return 5 per cent above the cash rate (currently 4.35 per cent) and limits losses in down markets to no more than 40 per cent.

[3] The Innova Lifestyle Preservation Portfolio targets a return 1.5 per cent above the cash rate (currently 4.35 per cent) and limits losses in down markets to no more than 5 per cent.